The Turkish economic crisis (Turkish: Türkiye ekonomik krizi) is an ongoing financial and economic crisis in Turkey.[1] It is characterized by the Turkish lira (TRY) plunging in value, high inflation, rising borrowing costs, and correspondingly rising loan defaults. The crisis was caused by the Turkish economy's excessive current account deficit and large amounts of private foreign-currency denominated debt, in combination with President Recep Tayyip Erdoğan's increasing authoritarianism and his unorthodox ideas about interest rate policy.[2][3][4][5] Some analysts also stress the leveraging effects of the geopolitical frictions with the United States. Following the detention of American pastor Andrew Brunson, who was confined of espionage charges after the failed 2016 Turkish coup d'état attempt, the Trump administration exerted pressure towards Turkey by imposing further sanctions. The economic sanctions therefore doubled the tariffs on Turkey, as imported steel rises up to 50% and on aluminum to 20%. As a result, Turkish steel was priced out of the US market, which previously amounted to 13% of Turkey's total steel exports.[6][7][8]

After a period of modest recovery in 2020 and early 2021 amid the COVID-19 pandemic, the Turkish lira plunged following the replacement of Central Bank chief Naci Ağbal with Şahap Kavcıoğlu,[9] who slashed interest rates from 19%[10] to 14%.[11] The lira lost 44% of its value in 2021 alone.[12][13][14]

Current account deficit and foreign-currency debt

| Economy of Turkey |

|---|

|

|

|

A longstanding characteristic of Turkey's economy is a low savings rate.[15] Since Recep Tayyip Erdoğan assumed control of the government, Turkey has been running huge and growing current account deficits, $33.1 billion in 2016 and $47.3 billion in 2017,[16] climbing to US$7.1 billion in the month of January 2018 with the rolling 12-month deficit rising to $51.6 billion,[17] one of the largest current account deficits in the world.[15] The economy has relied on capital inflows to fund private-sector excess, with Turkey's banks and big firms borrowing heavily, often in foreign currencies.[15] Under these conditions, Turkey must find approximately $200 billion a year to fund its wide current account deficit and maturing debt, while being always at risk of inflows drying up; the state has gross foreign currency reserves of just $85 billion.[3] The economic policy underlying these trends had increasingly been micro-managed by Erdoğan since the election of his Justice and Development Party (AKP) in 2002, and strongly so since 2008, with a focus on the construction industry, state-awarded contracts and stimulus measures. Although, research and development expenditure of the country (% of GDP) and the government expenditure on education (% of GDP) are nearly doubled during AKP governments, the desired outcomes could not be achieved[18][19][20] The motive for these policies have been described as Erdoğan losing faith in Western-style capitalism since the 2008 financial crisis by the secretary general of the main Turkish business association, TUSIAD.[20] Although not directly related in the conflict, the Turkish invasion of Afrin largely strained US-Turkish relations, and led to mass instability in Syria. This led to a global view of Turkey as an unnecessary aggressor.[21][22][23]

Investment inflows had already been declining in the period leading up to the crisis, owing to Erdoğan instigating political disagreements with countries that were major sources of such inflows (such as Germany, France, and the Netherlands).[2] Following the 2016 coup attempt, the government seized the assets of those it stated were involved, even if their ties to the coup were tenuous. Erdoğan has not taken seriously concerns that foreign companies investing in Turkey might be deterred by the country's political instability.[2] Other factors include worries about the decreasing value of lira (TRY) which threatens to eat into investors' profit margins.[2] Investment inflows have also declined because Erdoğan's increasing authoritarianism has quelled free and factual reporting by financial analysts in Turkey.[27] Between January and May 2017, foreign portfolio investors funded $13.2 billion of Turkey's $17.5 billion current account deficit, according to the latest available data. During the same period in 2018, they plugged just $763 million of a swollen $27.3 billion deficit.[28]

By the end of 2017, the corporate foreign-currency debt in Turkey had more than doubled since 2009, up to $214 billion after netting against their foreign-exchange assets.[29] Turkey's gross external debt, both public and private, stood at $453.2 billion at the end of 2017.[30] As of March 2018, $181.8 billion of external debt, public and private, was due to mature within a year.[31] Non-resident holdings of domestic shares stood at $53.3 billion in early March and at $39.6 billion in mid-May, and non-resident holdings of domestic government bonds stood at $32.0 billion in early March and at $24.7 billion in mid-May.[32] Overall non-residents' ownership of Turkish equities, government bonds and corporate debt has plummeted from a high of $92 billion in August 2017 to just $53 billion as of 13 July 2018.[28]

Government's 'action plans' to confront the crisis

The finance minister of the Turkish government, Albayrak unveiled a new economic program to stave off the recent financial crisis. The three-year plan aims to "reign in inflation, spur growth and cut the current account deficit".[33] The plan includes reduction on the government expenditures by $10 billion and suspension of the projects whose tender have not been carried out yet. The transformational phase of the plan will be focusing on value-added areas to increase the country's export volume and long-term production capacity with the goal of creating two million new jobs by 2021.[34] The program is expected to lower economic growth substantially in the short term (from a previous forecast of 5.5% to 3.8% in 2018 and 2.3% in 2019) but with a gradual growth increase by 2021 towards 5%.[35][36]

Presidential interference with the central bank

| ||

|---|---|---|

|

||

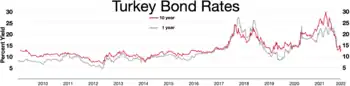

Turkey has experienced substantially higher inflation than other emerging markets.[37] In October 2017, inflation was at 11.9%, the highest rate since July 2008.[38] In 2018, the lira's exchange rate accelerated deterioration, reaching a level of 4.0 TRY per USD by late March, 4.5 TRY per USD by mid-May, 5.0 TRY per USD by early August and 6.0 as well as 7.0 TRY per USD by mid-August. Among economists, the accelerating loss of value was generally attributed to Recep Tayyip Erdoğan preventing the Central Bank of the Republic of Turkey from making the necessary interest rate adjustments.[39][40]

Erdoğan, who said interest rates beyond his control to be "the mother and father of all evil",[41] shared his unorthodox interest rate theories in a 14 May interview with Bloomberg and said that "the central bank can't take this independence and set aside the signals given by the president."[39][42] Presidential intervention with central bank policy comes with a general perception in international investment circles of a "textbook institutional decline" in Turkey, with Erdoğan seen increasingly reliant on politicians whose main qualifications for their jobs is loyalty, at the expense of more qualified and experienced options.[43] Erdoğan also has a long history of voicing Islamist discourse of interest-based banking as "prohibited by Islam" and "a serious dead-end".[44][45] He is also on record referring to interest rate increases as "treason".[4] Despite Erdogan's opposition, Turkey's Central Bank made sharp interest rates increases.[46]

The Financial Times quoted leading emerging markets financial analyst Timothy Ash analyzing that "Turkey has strong banks, healthy public finances, good demographics, pro-business culture but [has been] spoiled over past four to five years by unorthodox and loose macroeconomic management."[47] By mid-June, analysts in London suggested that with its current government, Turkey would be well advised to seek an International Monetary Fund loan even before the dwindling central bank foreign exchange reserves run out, because it would strengthen the central bank's hand against Erdoğan and help gain back investor confidence in the soundness of Turkey's economic policies.[48]

Economist Paul Krugman described the unfolding crisis as "a classic currency-and-debt crisis, of a kind we've seen many times", adding: "At such a time, the quality of leadership suddenly matters a great deal. You need officials who understand what's happening, can devise a response and have enough credibility that markets give them the benefit of the doubt. Some emerging markets have those things, and they are riding out the turmoil fairly well. The Erdoğan regime has none of that."[49]

In August 2023, Turkey's central bank raised interest rates by 7.5 points to 25% to tackle inflation, signaling a shift from previous policies. President Erdoğan's new economics team aims to restore policy orthodoxy and stabilize the economy. Despite the positive currency response, the lira remains near historic lows.[50][51]

Consequences in Turkey

During the emergence of the crisis, lenders in Turkey were hit by restructuring demands of corporations unable to serve their USD or EUR denominated debt, due to the loss of value of their earnings in Turkish lira. While financial institutions had been the driver of the Istanbul stock exchange for many years, accounting for almost half its value, by mid-April they accounted for less than one-third.[52] By late-May, lenders were facing a surge in demand from companies seeking to reorganise debt repayments.[53] By early-July, public restructuring requests by some of the country's biggest businesses alone already totalled $20,000,000,000 with other debtors not publicly listed or large enough to require disclosures.[54] The asset quality of Turkish banks, as well as their capital adequacy ratio, kept deteriorating throughout the crisis.[55] By June Halk Bankası, the most vulnerable of the large lenders, had lost 63% of its US dollar value since last summer and traded at 40% of book value.[56] However, it is hard to say that this is mainly due to the economic developments in Turkey since the valuation of Halkbank was largely affected by the rumors over the possible outcomes of the US investigation about the bank's stated help to Iran in evading US sanctions.[57]

Banks continuously heightened interest rates for business and consumer loans and mortgage loan rates, towards 20% annually, thus curbing demand from businesses and consumers. With a corresponding growth in deposits, the gap between total deposits and total loans, which had been one of the highest in emerging markets, began to narrow.[58][59] Nevertheless, this development has also led to incomplete or unoccupied housing and commercial real estate littering the outskirts of Turkey's major cities, as Erdoğan's policies had fuelled the construction sector, where many of his business allies are very active, to lead past economic growth.[24][59] In March 2018, home sales fell 14% and mortgage sales declined 35% compared to a year earlier. As of May, Turkey had around 2,000,000 unsold houses, a backlog three times the size of the average annual number of new housing sales.[25] In the first half of 2018, unsold stock of new housing kept increasing, while increases in new home prices in Turkey were lagging consumer price inflation by more than 10 percentage points.[60]

While heavy portfolio capital outflows persisted, $883,000,000 in June, with official foreign exchange reserves declining by a $6,990,000,000 during June, the current account deficit started narrowing in June, due to the weakened exchange rate for the lira. This was perceived as a sign of getting balanced economy.[61] Turkish Lira started recover its losses as of September 2018 and the current account deficit continued to shrink.[62]

As a consequence of the earlier monetary policy of easy money, any newfound fragile short-term macroeconomic stability is based on higher interest rates, thus creating a recessionary effect for the Turkish economy.[63] In mid-June, the Washington Post carried the quote from a senior financial figure in Istanbul that "years of irresponsible policies have overheated the Turkish economy. High inflation rates and current account deficits are going to prove sticky. I think we are at the end of our rope."[64]

Suicides

In January 2018, a worker burnt himself in front of parliament.[65] Another person also burnt himself in governor's office of Hatay.[66]

In November 2019 four siblings were found dead in an apartment in Fatih, Istanbul, having committed suicide because they were unable to pay their bills. The price of electricity increased in 2019 around 57% and youth unemployment stood around 27%. The electricity bill for the apartment had not been paid for several months.[67]

A family of four including two children 9 and 5 years old was similarly found in Antalya. A note left behind detailed the financial difficulties the family was experiencing.[67][68]

In mid-November The Guardian reported that an anonymous benefactor had paid off some debts at local grocery stores in Tuzla and left envelopes of cash on doorstops after the suicides.[68]

AK Parti officials and media have denied that the recent deaths were caused by the rising cost of living.[67][68]

Timeline of events (2018)

- 12 February – Yıldız Holding unexpectedly requested to restructure as much as $7,000,000,000 in loans.[69]

- 21 February – Cemil Ertem, senior economic adviser to President Recep Tayyip Erdoğan, published an opinion piece in the Daily Sabah suggesting that the IMF's policy advice for Turkey's central bank to raise short term interest rates should be ignored and that "not only Turkey, but all developing countries, should do the opposite of what the IMF preaches."[70]

- 5 April – Mehmet Şimşek, the Deputy Prime Minister in charge of the economy, sought to resign due to disagreement with Erdoğan about the latter's interference with central bank policy; but was later convinced to withdraw his resignation.[71]

- 7 April – Doğuş Holding applied to their banks for debt restructuring. Doğuş' outstanding loans stood at the equivalent of 23,500,000,000 Turkish lira (£2,765,597,500) at the end of 2017; up 11% from the year before.[72]

- 18 April – Erdoğan announced that the upcoming general election would be held on 24 June, eighteen months earlier than scheduled.

- 14 and 15 May – In a televised interview with Bloomberg and in a meeting with global money managers in London, Erdoğan said that after the elections, he intended to take greater control of the economy, including de facto control over monetary policy, and to implement lower interest rates; this caused "shock and disbelief" among investors about the central bank's ability to fight inflation and stabilise the lira.[73][42]

- 23 May – Foreign exchange bureaus in Istanbul temporarily stopped trading amidst an extreme dive in the price of the lira.[74] On the same day, the Turkish Statistical Institute reported another slip in consumer confidence over the month of May, with all sub-indices decreasing. On 25 May 2018, it reported a sharp drop in confidence in Turkey's services, retail trade, and construction sectors over the month of May.[75] Also on the same day, the Central Bank of Turkey raised interest rates at an emergency meeting of its Monetary Policy Committee, bowing to pressure from financial markets. The central bank raised its late liquidity window rate by 300 basis points to 16.5%.[76] Taken against the vociferous objections of Erdoğan, this step brought temporary relief for the lira exchange rate.[77]

- 28 May – Turkey's central bank announced an operational simplification of its monetary policy, effective 1 June, coming with the announcement of another interest rate hike. The one-week repo rate, at 8 percent—currently not used—is to be raised to 16.5 percent and become the future benchmark of monetary policy. The current benchmark late liquidity window rate, now at 16.5 percent, will be fixed at 150 basis points above the one-week repo rate, which would now be 18 percent. The lira somewhat firmed in response.[78][79]

- 30 May – The Turkish Statistical Institute reported economic confidence sliding steeply in May to a value of 93.5, the lowest level in 15 months, since the aftermath of the 2016 coup attempt.[80]

- 30 May – GAMA Holding sought to ease repayment terms for $1.5 billion of loans with creditors.[81]

- 30 May – Turkey's central bank released minutes of the crucial 23 May Monetary Policy Committee meeting, saying that "the tight stance in monetary policy will be maintained decisively until the inflation outlook displays a significant improvement and becomes consistent with the targets", the latter being 5 percent by law.[82]

- 1 June – The Istanbul Chamber of Industry published its index of manufacturing in Turkey for the month of May, stating that with a sharp drop for the second consecutive month, manufacturing conditions deteriorated to the worst since 2009, elaborating that "inflationary pressures remained marked in May, cost burdens continued to rise in the manufacturing sector."[83]

- 4 June – Turkey's statistics institute reported the annual inflation rate for May as risen to 12.2 percent from 10.9 percent the previous month, just below a 14-year high of last November, while monthly inflation was 1.6 percent.[84][85]

- 6 June – At the Borsa Istanbul, Turkey's main stock index BIST-100 dropped 1.5 percent to the lowest level in dollar terms since the global financial crisis in 2008.[86]

- 7 June – Turkey's central bank at its regular Monetary Policy Committee meeting raised its benchmark repo rate by 125 basis points to 17.75 percent. The move beat market expectations, resulting in immediate gains for the lira, and the yield on the benchmark 10-year lira bond eased, after touching a record-high 15.41 percent on 6 June.[87]

- 10 June – Turkey's Automotive Manufacturers Association published data for the month of May, showing car sales sliding to the lowest level since 2014. Passenger car sales slumped by 13 percent when compared to May 2017, while sales of commercial vehicles dropped 19 percent.[88]

- 11 June – Turkey's central bank released financial data for April, with the account deficit widening by $1.7 billion to $5.4 billion.[89]

- 13 June – Turkish President Recep Tayyip Erdoğan's senior economic adviser Cemil Ertem in an opinion piece in the Daily Sabah said that the unorthodox idea that it would be wrong to see inflation as a monetary phenomenon,[90] leading to a sharp slide in the value of the lira and of Turkey's benchmark 10-year lira bonds, with yields on the latter reaching a record-high of 16.25 percent.[91][92]

The Turkish Lira regained a significant proportion of its losses within the three months after July 2018. According to the models by IMF and International Institute of Finance made at the time, the lira was getting closer to the fair value but was still slightly undervalued.[93]

The Turkish Lira regained a significant proportion of its losses within the three months after July 2018. According to the models by IMF and International Institute of Finance made at the time, the lira was getting closer to the fair value but was still slightly undervalued.[93] - 14 June – Turkish President Recep Tayyip Erdoğan in a televised interview said that his government would "conduct an operation against" international credit ratings agency Moody's Investors Service following elections on 24 June.[94][95] The next day, the lira finished its worst week since 2008, tumbling 5.7 per cent relative to the dollar, while also hitting its worst weekend close ever at US$4.73/TRY.[47]

- 24 June – In the Turkish general election, Erdoğan retained the office of president while his Justice and Development Party (AKP) narrowly lost its majority in parliament but achieved such majority together with its alliance partner the Nationalist Movement Party (MHP). The day after, the Turkish Industry and Business Association (TÜSİAD) urgently called for economic reforms.[96]

- 28 June – The Turkish Statistical Institute reported its economic confidence index dropping in June for the fifth straight month, with construction sector confidence leading the declines.[97]

- 3 July – The Turkish Statistical Institute reported that Turkey's annual inflation rate surged to 15.4 percent in June, the highest level since 2003. Consumer price inflation climbed 2.6 percent month-on-month in June, exceeding annual price increases in many developed economies. Turkey's annual inflation rate now was about four times the average in emerging markets. Producer price increases accelerated to 23.7 percent from 20.2 percent the previous month.[99] On the same day, the Automotive Distributors Association said that sales of the commercial vehicles sank 44 percent in June from June 2017, while car sales fell 38 percent.[100]

- 5 July – Bloomberg reported that Turkish and international banks were taking control of Türk Telekom, Turkey's biggest telephone company, due to billions of dollars in unpaid debt. Creditors set up a special purpose vehicle to acquire the company as they try to resolve Turkey's biggest-ever debt default.[98] The same day, Bereket Enerji group was reported seeking buyers for two power plants as it negotiates with banks to refinance $4 billion in debt.[54]

- 9 July – Erdoğan appointed his son-in-law Berat Albayrak as economic chief of his new administration, in charge of a new ministry of treasury and finance. Erdoğan also appointed Mustafa Varank, a close adviser who had overseen a pro-government social media team on Twitter and elsewhere, to industry minister, the other key economy portfolio.[101] These announcement fueled investor unease about competence and orthodoxy of economic policymaking, with the Turkish lira losing 3.8 percent of its value within one hour after Albayrak's appointment.[102] Same day, Erdoğan by presidential decree appropriated to himself the authority to appoint the central bank governor, his deputies and the monetary policy committee members.[103]

- 11 July – The lira dropped 2.5 percent to 4.82 per dollar, its weakest level since falling to an all-time low of 4.92 against the U.S. currency in May. The stock market in Istanbul dropped 5.2 percent to 91.290 points. Yields on government debt surged.[101] The next day, the lira touched an all-time low of 4.98 lira for a US dollar.[104] Two days later, the lira recorded its biggest weekly slump in almost a decade. The benchmark Borsa Istanbul 100 Index fell the most since the foiled coup in 2016, with the selloff dragging price-to-estimated earnings valuations to the lowest in more than nine years. The 10-year government bond yield surged almost 100 basis points this week.[105]

- 19 July – ÇEL-MER Çelik Endüstrisi, a leading Turkish steel producer also operating in the automobile sector, agriculture, white goods, machinery production and the defence industry, sought bankruptcy protection from the courts after it failed to repay its debts.[106]

- 20 July – Ozensan Taahhut, a large Turkish construction company which has carried out construction contracts for state housing authority TOKI, the Justice Ministry, the Health Ministry and various municipalities, filed for bankruptcy protection.[107]

- 24 July – The Central Bank of Turkey at a meeting of its Monetary Policy Committee unexpectedly left the benchmark interest rate for its lending unchanged at 17.75 percent despite the latest hike in inflation, leading to a selloff in the lira currency as well as in Turkey's dollar-denominated government bonds and in Turkey's stock market.[108][109][110] In the words of Brad Bechtel, global head of foreign exchange at US investment bank Jefferies, the central bank's decision to hold rates left Turkey as "the pariah of emerging markets".[28]

- 31 July – Turkey's central bank acknowledged it will not meet its 5 percent inflation target for three more years, disappointing investors seeking signs that monetary policy would tighten. Although Governor Murat Cetinkaya pledged to raise borrowing costs when needed, he predicted 13.4 percent inflation through this year, 9.3 percent through 2019 and 6.7 percent by the end of 2020.[111] The same day, the Turkish lira heading for its longest streak of monthly losses since an International Monetary Fund bailout in 2001, the Banks Association of Turkey (TBB) drew up a framework of principles for restructuring loans that exceed 50 million lira: If lenders with exposure to at least 75 percent of the total owed agree, a committee of lenders should order measures such as changes to shareholder structure and management, asset sales, spinoffs and capital injections, resolving restructurings within 150 days.[112]

- 1 August – Due to the weakening lira, Turkey's state pipeline operator BOTAŞ raised the price of natural gas used by electric power plants by 50 percent. BOTAŞ also raised natural gas prices for residential use. The same day, the energy regulation authority raised electricity prices for industrial and residential use.[113] Also the same day, the Istanbul Chamber of Industry said in a monthly survey of manufacturers that producer price inflation in July accelerated to the highest pace in more than a decade, after already having accelerated to 23.7 percent in June due to the Erdoğan government stimulating economic growth with a series of measures ahead of elections on 24 June.[114]

- 3 August – The Turkish Statistical Institute reported that Turkey's annual inflation rate increased to 15.9 percent, from 15.4 percent in June, extending the highest level since 2003. Producer price inflation climbed to 25 percent from 23.7 percent in June.[115]

- 9 August – Late in the day, Erdoğan in a speech called upon supporters not to pay heed to "various campaigns under way against Turkey", adding: "If they have dollars, we have our people, our righteousness and our God."[116] As these remarks reduced markets' hope that the Turkish government were willing to tighten monetary policy or begin economic reform, throughout the night and into the next morning, the lira in a dramatic fall lost almost 10 percent of its value, touching the mark of 6 lira for a US dollar.[116]

- 14 August – Erdoğan announced a policy of boycott of US electronic products.[117] On the same day, Turkey's banking regulator placed comprehensive limits on use of credit card instalments.[118]

- 15 August – Qatar pledged to invest $15 billion in Turkey making lira rally by 6%.[119][120]

- 16 August – The Turkish Statistical Institute reported that Turkey's industrial production declined by 2 percent in June from May, contracting for a second-straight month.[121]

- 27 August – The Turkish Statistical Institute reported its economic confidence index dropping in August from 91.9 to 88.0, with another sharp drop in construction sector confidence leading the declines.[122]

- 28 August – Moody's downgraded another 20 Turkish financial institutions.[123] The ratings agency estimated that Turkey's operating environment had "deteriorated beyond its previous expectations", and predicted that this deterioration would continue.[124]

- 29 August – Ownership of insolvent Turk Telekom transferred to "a joint venture of creditor banks."[125] Another measure of Turkish economic confidence slid from 92.2 in July to 83.9 in August, its lowest level since March 2009.[126] Research from consultancy Capital Economics indicated that Turkey has entered a 'steep' recession and predicted that the Turkish economy would contract by as much as 4% in the fourth quarter of 2018, before stagnating in 2019.[127]

- 30 August – Erkan Kilimci, the deputy governor of the Turkish central bank, resigned, putting further pressure on the lira, which fell almost 5% against the dollar throughout the day.[128][129][130]

- 3 September – Turkey's central bank announced that inflation in August had risen to nearly 18 percent, a 15-year high.[131]

- 10 September – Data released by the Turkish Statistical Institute showed a slowdown in Turkey's economic growth in the second quarter of 2018. The country saw a 5.2 percent increase in GDP in the June quarter, compared to 7.3 percent in the first quarter of the year.[132] Finance minister Berat Albayrak predicted that the economic slowdown would become more visible in the third quarter of 2018.[133]

- 12 September – Erdoğan sacked the entire management staff of Turkey's sovereign wealth fund and named himself chairman of the fund.[134][135] He also appointed Zafer Sonmez, formerly of Malaysia's government investment vehicle, as general manager.[135] Erdoğan's son-in-law Berat Albayrak was named as his deputy on the board of the sovereign wealth fund.[136]

- 13 September – Erdoğan published an executive decree requiring all contracts between two Turkish entities to be made in lira. The measure took effect immediately and requires existing contracts to be reindexed to the lira within 30 days.[137] During a speech in Ankara, Erdoğan sharply criticized the Turkish central bank and urged the bank to cut interest rates.[138][139] Instead, the central bank sharply increased its benchmark lending rate, from 17.75 percent to 24 percent, beating Reuters' predictions of a hike to 22 percent.[140]

Timeline of events (2021)

- 25 October – The sought-after expulsion of ambassadors from Canada, Denmark, France, Germany, the Netherlands, Norway, Sweden, Finland, New Zealand and the United States also caused a fall of the Turkish Lira.[141] The expulsion was later not carried out.[142]

- 18 November – The Central Bank of the Republic of Turkey (CBRT) cut its rate by 100 basis points to 15%, and signaled that the rates would be cut further before the end of the year. The rates had been slashed by 400 basis points since September 2021.[143][144] After the rate cut decision, the lira fell to a new record low trading at 10.7738 against the dollar, reversing earlier gains.[143]

- 22 November – Speaking after the Cabinet meeting, Erdoğan declared that a tight interest-rate policy will not lower inflation and vowed that the country will succeed in its "economic war of independence".[145][146] After Erdoğan's speech, the lira went into a free fall, crashing to a record low of 13.44 to the dollar,[147][148] before recovering to 12.75.[149] Many local and international companies operating in Turkey, including Apple,[150] halted Lira-denominated sales.[151][152]

- 16-17 December - Under Erdoğan's pressure, the CBRT cut its interest rate again, by 100 basis points, despite warnings not to do so, which made lira fall by 5.6%, to 15.689 TRY to the US dollar.[153] The next day, the BIST 100 index fell by a total of 8% during the trading day, triggering a circuit breaker on the stock exchange. The lira fell almost 7% that day, touching the 17 TRY/USD mark.[154]

- 20 December - Erdoğan doubled down on his ultra-loose monetary policy by citing the usury doctrine (which prohibits lending with interest) and insisting that the bank would not stop cutting its interest rates, prompting another currency selloff and plunging the lira to about 17.60 to the US dollar.[155][156] The currency lost 58% of the value from the beginning of the year up to that date.[157] The lira dropped to an all-time low of 18.36 TRY to the dollar but Erdoğan stepped in, announcing measures designed to protect lira-denominated deposits and to encourage converting foreign exchange deposits to liras. The market reacted immediately, moving the Turkish currency to ca. 13.50 liras/USD, after peaking at about 12.30, in what was the widest swing in the exchange rate since 1983.[158][159]

- 21 December - frenetic trading continues, with the exchange rate dropping to 11.0935 per dollar before going up to about 12.90 later in the morning and 12.50 by the afternoon.[160] Despite lira's gains, its strength is still severely diminished since January 2021, when 7.40 liras was enough to buy a US dollar.[161]

- 23 December - amid continued optimism related to the new economic plan and as the state banks have poured almost $7 billion during the week preceding December 23 to stabilise the currency, the USD/TRY exchange rate falls another 10% to oscillate around 11 lira to the US dollar.[162] The lira hit 10.5343 to the dollar mark during trading,[163] strengthening by 40% since December 20.[164] Investors, however, brace for more volatility as the Borsa Istanbul 100 index tumbles.[163]

Timeline of events (2022)

- 4 July - Annual rate of inflation from June 2021 to June 2022 is reported to have reached 78.6%, with food prices doubling and transport costs increasing 123%. Since the beginning of the year, the Turkish lira has lost 20% of its value against the US dollar.[165]

International consequences

The crisis has brought considerable risks of financial contagion. One aspect concerns risk to foreign lenders, where according to the Bank for International Settlements, international banks had outstanding loans of $224 billion to Turkish borrowers, including $83 billion from banks in Spain, $35 billion from banks in France, $18 billion from banks in Italy, $17 billion each from banks in the United States and in the United Kingdom, and $13 billion from banks in Germany.[166][167] Another aspect concerns the situation of other emerging economies with high levels of debt denominated in USD or EUR, with respect to which Turkey may either be considered "a canary in the coalmine" or even by its crisis and the bad handling thereof increase international investors' retreat for increased perception of risk in such countries.[168] On 31 May 2018, the Institute of Financial Research (IIF) reported that the Turkish crisis has already spread to Lebanon, Colombia and South Africa.[169] The fall of the value of the lira has also impoverished the inhabitants in northern Syria, who use the lira for everyday transactions,[170] and impacted the hazelnut industry hard, which is economically important in the country and produces 70% of world's hazelnuts.[171]

Timeline of events (2018)

- 19 January – Fitch Ratings closed its Istanbul office after Erdoğan made numerous negative comments about credit rating agencies.[172][2]

- 7 March – Credit ratings agency Moody's Investors Service downgraded Turkey's sovereign debt, warning of an erosion of checks and balances under Erdoğan, and saying that the Turkish military operation in Afrin, having strained ties with Washington and drawn the country deeper into the Syrian civil war, had added an extra layer of geopolitical risk.[173]

- 1 May – Credit ratings agency Standard & Poor's cut Turkey's debt rating further into junk territory, citing widening concern about the outlook for inflation amid a sell-off in the Turkish lira currency.[174]

- 22 May – Turkish government dollar bonds traded at prices lower than those of Senegal.[175] On the same day, the Turkish Republic of Northern Cyprus (TRNC) government started discussing abandonment of the Turkish lira for another currency.[176]

- 23 May – the Central Bank of the Turkish Republic of Northern Cyprus discontinues offering loans to their citizens unless their salary is paid in a foreign currency.[177]

- 28 May – Jordan terminated its free-trade agreement with Turkey, which had lately seen Turkish exports to Jordan increase fivefold.[178]

- 30 May – Credit ratings agency Moody's Investors Service lowered its estimate for growth of the Turkish economy in 2018 from 4 percent to 2.5 percent and in 2019 from 3.5 percent to 2 percent.[179]

- 6 June – Bloomberg reported that Astaldi, an Italian multinational construction company, was poised to sell its stake in the flagship Yavuz Sultan Selim Bridge project for $467 million.[180] The project had failed to meet projections, requiring Ankara to boost operators' revenue from treasury coffers,[26] and since early 2018, the partners in the joint venture had sought restructuring of $2.3 billion of debt from creditors.[53]

- 7 June – Credit ratings agency Moody's Investors Service downgraded the ratings of 17 Turkish banks, reasoning "that the operating environment in Turkey has deteriorated, with negative implications for the institutions' funding profile."[181] Also on 7 June, Moody's put eleven of Turkey's top companies under review, because their credit quality was correlated in varying degrees to the government in Ankara. The firms included Koç Holding, Turkey's biggest industrial conglomerate, Doğuş Holding, which has applied to banks to restructure some of its debt, and Turkish Airlines.[182]

- 18 June – Credit ratings agency Fitch Ratings lowered its estimate for growth of the Turkish economy in 2018 from 4.7 percent to 3.6 percent, citing reasons including an anticipated reduction in government stimulus.[183]

- 26 June – The European Union's General Affairs Council stated that "the Council notes that Turkey has been moving further away from the European Union. Turkey's accession negotiations have therefore effectively come to a standstill and no further chapters can be stated for opening or closing and no further work towards the modernisation of the EU-Turkey Customs Union is foreseen."[184][185]

- 13 July – Credit ratings agency Fitch Ratings downgraded Turkey's debt rating further into junk with negative outlook, reasoning that "economic policy credibility has deteriorated in recent months and initial policy actions following elections in June have heightened uncertainty (...) Monetary policy credibility has been damaged by comments by President Erdoğan suggesting a greater role of the presidency in setting monetary policy after the elections (...) Monetary policy has persistently been unable to bring inflation near its 5% target and inflation expectations have become unanchored. Key figures from the previous administration with reformist credentials were excluded from a new cabinet, appointed on 9 July, while the son-in-law of the president was appointed as Minister of Treasury and Finance."[186]

- 20 July – The government of Germany lifted export credit guarantee sanctions against Turkey, which it had implemented a year earlier in order to protest the ongoing state of emergency (OHAL) in Turkey and to effect the release of German citizen Deniz Yücel and others held under arrest by the Turkish government, after the German citizens concerned were freed and the state of emergency was lifted.[187][188]

- 26 July – European rating agency Scope Ratings placed Turkey's BB+ sovereign ratings on review for downgrade, citing i) "Deterioration in Turkey's economic policy and governance framework both before and in following the June election, which weigh on the effectiveness and credibility of fiscal, monetary and structural economic policy management" alongside ii) "Increasing downside risks to Turkey's macroeconomic stability stemming from external vulnerabilities."[189]

- 27 July – At their summit in Johannesburg between 25 and 27 July, BRICS countries rejected Erdoğan's desire for Turkey to join the bloc.[190]

- 10 August – The European Central Bank voiced increased concerns about the exposure of some of the Euro currency area's biggest lenders to Turkey – chiefly BBVA, UniCredit and BNP Paribas – in light of the lira's dramatic fall.[116] On the same day, the US government started "a bullet a day" economic sanctions against Turkey, designed to effect the release of US citizen Andrew Brunson and 15 others, held under arrest (on charges described as a sham by U.S. officials) by the Turkish government; in a first step, US President Donald Trump announced a doubling of tariffs on Turkish steel and aluminum.[191][192]

- 16 August – European rating agency Scope Ratings downgraded Turkey's sovereign ratings to BB− from BB+ and revised the Outlook to Negative, citing in the downgrade: i) "Deterioration in Turkey's economic policy predictability and credibility, in view of monetary, fiscal and structural economic policies inconsistent with the rebalancing of the economy onto a more sustainable path"; ii) "Accentuated macroeconomic imbalances"; and iii) "The impact of balance of payment weaknesses on modest levels of international reserves."[193]

- 17 August – Credit ratings agencies Standard & Poor's and Moody's downgraded Turkey's debt rating further into junk, down to B+ (S&P) and Ba3 (Moody's).[194] S&P predicted a recession for 2019 and inflation to peak at 22% in 2018, before subsiding to below 20% by mid-2019.[194] Moody's said that the chances of a swift and positive resolution to Turkey's turmoil was becoming less likely thanks to the "further weakening of Turkey's public institutions and the related reduction in the predictability of Turkish policy making."[194]

Timeline of events (2021)

- 11 September - Moody's cuts the Turkish debt rating again, downgrading it to B2 (five grades below investment level) with a negative outlook.[195]

- 2 December - Fitch Ratings affirmed its BB− credit rating but revised the outlook to negative, citing "premature monetary policy easing cycle."[196]

- 10 December - Standard & Poor's lowered its forecast from stable to negative, warning of a potential downgrade to Turkey's debt rating if the situation worsens.[197]

- 14 December - Due to the unpredictability of the currency value, the Swiss-based bank UBS decided to discontinue coverage of the USD/TRY pair for its clients and retracted all prior advice for investors in the area.[198]

Improvements

On 15 August 2018, Qatar pledged to invest $15 billion in the Turkish economy making the lira rally by 6%.[120][119]

On 29 November 2018, the Turkish lira hit a 4-month high in value against the US Dollar. It recovered from 7.0738 against the dollar to 5.17 on 29 November, an increase of 36.8%. Reuters also reported in a response to a poll that it expects the inflation to decrease for the November month. The reasons that were given are the positive exchanges, discounts on products and tax cuts.[199]

Politics and corruption

Turkish government statements of a foreign plot

From a background of a long history of promoting conspiracy theories by the Turkish government of Erdoğan and the AKP,[200][201][202] with the emergence of the financial crisis, members of the government have stated that the crisis were not attributable to the government's policies, but rather were the conspiratorial work of shadowy foreign actors, seeking to harm Turkey and deprive President Erdoğan of support.[203][2] During the major lira sell-off on 23 May 2018, Turkey's energy minister, Erdoğan's son-in-law Berat Albayrak, told the media that the recent sharp drop in the value of the lira was the result of the machinations of Turkey's enemies.[204] On 30 May 2018, foreign minister Mevlüt Çavuşoğlu said that the plunge of the lira would have been caused by an organized campaign masterminded abroad, adding that the conspiracy would include both "the interest rate lobby" and "some Muslim countries", which he however refused to name.[205] At an election campaign rally in Istanbul on 11 June 2018, Erdoğan said that the recently published 7.4 percent GDP growth figure for the January to March period would demonstrate victory against what he called "conspirators" whom he blamed for May's heavy falls of the Turkish lira.[206] In August, Erdoğan started using the formula of "the world fighting an economic war against Turkey".[207] Part of this idea likely had to do with a row with America regarding the case of U.S. citizen Andrew Brunson, which had a deleterious effect on Turkey-U.S. relations. Alongside sanctions on specific government figures, tariffs were also used by both countries to create economic pressure. Vox describes it as a "trade spat".[208] Commentators such as Vox's Jen Kirby have pointed to the pivotal role Brunson's case plays in it.

A tariff on steel and other products was placed on Turkey by the United States. However, Sarah Sanders has described the American tariffs as related to "national defense",[209] and thus not changeable by circumstances, noting that only the sanctions would be lifted upon the release of Brunson.

Erdogan describes these tariffs as an "economic war" against Turkey.[210]

In retaliation, Turkey announced tariffs on US products, including the iPhone.[211] The tariffs by Turkey cover products such as American cars, and coal. At a White House Press conference, Sanders described these as "regrettable".[212] Sanders said that the Turkish economic trouble was part of a long-term trend that was not related to any actions America did.

On 22 August 2018, John R. Bolton, speaking to Reuters, said "the Turkish government made a big mistake in not releasing Pastor Brunson... [e]very day that goes by that mistake continues, this crisis could be over instantly if they did the right thing as a NATO ally, part of the West, and release pastor Brunson without condition."[213] He went on to state that Turkey's membership in NATO was not as much of a major foreign policy issue for the US, but instead the American focus was on individuals that the United States said Turkey is holding for non-legitimate reasons. Bolton also expressed skepticism in regard to Qatar's attempts to infuse money in the Turkish economy.[213] Erdogan spokesman Ibrahim Kalin, in a written statement, described these remarks as an admission that, contra Sanders, the American tariffs were, in fact, in relation to the Brunson case and proof that the US intended them to economically war against Turkey.[214]

According to a poll from April 2018, 42 percent of Turks, and 59 percent of Erdoğan's governing AKP voters, saw the decline in the lira as a plot by foreign powers.[215] In another poll from July, 36 percent of survey respondents said it the AKP government was most responsible for the depreciation of the Turkish lira, while 42 percent said it was foreign governments.[216] This was said to be caused by the government's far-reaching control over the media via the fact that those respondents mostly reading alternative views in the Internet were more likely to see their own government responsible, at 47 percent, than foreign governments, at 34 percent.[216]

1.jpg.webp)

Crisis as a topic in the June 2018 elections

On 16 May, a day after president Erdoğan had unsettled markets during his visit to London by suggesting he would curb the independence of the Central Bank of Turkey after the election, Republican People's Party (CHP) presidential candidate Muharrem İnce and İYİ Party presidential candidate Meral Akşener both vowed to ensure the independence of the central bank if elected.[217][218][219]

In a 26 May interview on his campaign trail, CHP presidential candidate Muharrem İnce said on economic policy that "the central bank can only halt the lira's slide temporarily by raising interest rates, because it's not the case that depreciation fundamentally stems from interest rates being too high or too low. So, the central bank will intervene, but the things that really need to be done are in the political and legal areas. Turkey needs to immediately be extricated from a political situation that breeds economic uncertainty, and its economy must be handled by independent and autonomous institutions. My economic team is ready, and we have been working together for a long time."[220]

In a nationwide survey conducted between 13 and 20 May, 45 percent saw the economy (including the steadily-dropping lira and unemployment) as the greatest challenge facing Turkey, with foreign policy at 18 percent, the justice system at 7 percent and terror and security at 5 percent.[221]

İYİ Party presidential candidate Meral Akşener, supported by a strong economic team led by former Central Bank Governor Durmuş Yılmaz,[24] had on 7 May presented her party's economic program, saying that "we will purchase the debts from consumer loans, credit card and overdraft accounts of 4.5 million citizens whose debts are under legal supervision of banks or consumer financing companies and whose debts have been sold to collection companies as of 30 April 2018. It is our duty to help our citizens with this condition, as the state has helped big companies in difficult situations."[222]

On 13 June, CHP leader Kemal Kılıçdaroğlu reiterated the opposition's view that the state of emergency in place since July 2016 were an impediment to Turkey's currency, investment and economy, vowing that it be lifted within 48 hours in case of an opposition victory in the elections.[223] İYİ Party leader and presidential candidate Akşener had made the same vow on 18 May,[224] while CHP presidential candidate İnce had said on 30 May: "Foreign countries do not trust Turkey, thus they do not invest in our country. When Turkey becomes a country of the rule law, foreign investors will invest thus the lira will gain value."[225] Early June, President Recep Tayyip Erdoğan had suggested in an interview that the issue of lifting the emergency rule would be discussed the elections, however asked back: "What's wrong with the state of emergency?"[223]

Statements of corruption and insider trading

In early April 2017, Peoples' Democratic Party (HDP) presidential candidate Selahattin Demirtaş, writing in a letter from prison—where he has been held without conviction since 2016, charged of inciting violence with words—[226] saying that "the biggest problem for the youth in Turkey is corruption which has accompanied with AKP governance."[227]

In late May 2018, Republican People's Party (CHP) deputy chair Aykut Erdoğdu called the Financial Crimes Investigation Board of Turkey (MASAK) to investigate exchange rate transactions made amid rapid decline and partial recovery in the value of the lira on 23 May, saying there was insider trading by market participants who knew of the 300 basis points interest rate hike by the Turkish central bank in advance.[228]

In early July 2018, Turkey's Capital Markets Board (SPK) said that until the end of August share purchases on the Borsa Istanbul by people party to the relevant company's internal information, or by those close to them (insider trading), would not be subject to a stock market abuse directive. Amid a public outcry, it suspended the directive some days later, without giving a reason for the move.[229][230]

See also

References

- ↑ Michaelson, Ruth (16 May 2023). "Turkey's economic crisis expected to deepen after Erdoğan tops poll". The Guardian. ISSN 0261-3077. Retrieved 16 May 2023.

- 1 2 3 4 5 6 7 Borzou Daragahi (25 May 2018). "Erdogan Is Failing Economics 101". Foreign Policy. Archived from the original on 14 April 2019. Retrieved 30 January 2022.

- 1 2 "Inflation rise poses challenge to Erdogan as election looms". Financial Times. 5 June 2018. Archived from the original on 8 April 2019. Retrieved 30 January 2022.

- 1 2 Matt O'Brien (13 July 2018). "Turkey's economy looks like it's headed for a big crash". Washington Post. Archived from the original on 8 April 2019. Retrieved 30 January 2022.

- ↑ "Turkey's Lessons for Emerging Economies – Caixin Global". www.caixinglobal.com. Archived from the original on 28 April 2019. Retrieved 20 August 2018.

- ↑ "International Trade Administration" (PDF). August 2019.

- ↑ Goujon, Reva (16 August 2018). "Making Sense of Turkey's Economic Crisis". Stratfor. Archived from the original on 16 August 2018.

- ↑ Jack Ewing (17 August 2018). "Life in Turkey Now: Tough Talk, but Fears of Drug Shortages". New York Times. Archived from the original on 7 September 2018. Retrieved 30 January 2022.

- ↑ Spicer, Jonathan Spicer; Erkoyun, Ezgi (22 March 2021). "Turkish lira plunges to near record low after Erdogan sacks central bank chief". Reuters. Archived from the original on 27 October 2021. Retrieved 25 October 2021.

- ↑ Kidera, Momoko (21 October 2021). "Turkey cuts interest rates again despite calls for course change". Nikkei Asia. Archived from the original on 25 January 2022. Retrieved 22 October 2021.

- ↑ "Turkish lira drops to new all-time low after rates slashed". CNBC. 22 October 2021. Archived from the original on 26 January 2022. Retrieved 24 October 2021.

- ↑ Turak, Natasha (January 13, 2022). Erdogan blames Turkey’s currency problems on ‘foreign financial tools’ as central bank reserves fall. Archived 10 May 2022 at the Wayback Machine CNBC.

- ↑ Isil Sariyuce and Ivana Kottasová (23 June 2019). "Istanbul election rerun won by opposition, in blow to Erdogan". CNN. Archived from the original on 29 August 2019. Retrieved 20 August 2019.

- ↑ Gall, Carlotta (23 June 2019). "Turkey's President Suffers Stinging Defeat in Istanbul Election Redo". The New York Times. ISSN 0362-4331. Archived from the original on 6 August 2019. Retrieved 20 August 2019.

- 1 2 3 "How Turkey fell from investment darling to junk-rated emerging market". The Economist. 19 May 2018. Archived from the original on 23 February 2019. Retrieved 23 May 2018.

- ↑ "Turkey's current account deficit at $5.4 billion in April". Hurriyet Daily News. 11 June 2018. Archived from the original on 28 April 2020. Retrieved 30 January 2022.

- ↑ "Turkish current account deficit more than doubles". Ahval. 12 March 2018. Archived from the original on 12 June 2018. Retrieved 22 May 2018.

- ↑ "Research and development expenditure (% of GDP)". The World Bank Data. UNESCO Institute for Statistics. Archived from the original on 19 May 2019. Retrieved 31 October 2018.

- ↑ "Government expenditure on education, total (% of GDP)". United Nations Educational, Scientific, and Cultural Organization ( UNESCO ) Institute for Statistics. Archived from the original on 31 October 2018. Retrieved 31 October 2018.

- 1 2 3 Marc Champion; Cagan Koc (22 June 2018). "A Crazy $200 Billion Says Erdogan Wins His Election Bet". Bloomberg L.P. Archived from the original on 21 April 2019. Retrieved 30 January 2022.

- ↑ "Potential Turkish Military Move on Afrin Risks Wider War". 19 January 2018. Archived from the original on 17 May 2021. Retrieved 30 January 2022.

- ↑ "What's next for Turkey, the US, and the YPG after the Afrin operation?". 26 January 2018. Archived from the original on 19 March 2018. Retrieved 30 January 2022.

- ↑ "Why are world leaders backing this brutal attack against Kurdish Afrin? | David Graeber". TheGuardian.com. 23 February 2018. Archived from the original on 6 October 2021. Retrieved 30 January 2022.

- 1 2 3 Mark Bentley (19 April 2018). "Turkish real estate ills reflect Erdoğan's snap poll decision". Ahval. Archived from the original on 12 June 2018. Retrieved 27 August 2018.

- 1 2 "Turkish property firms to slash prices in one-month drive to revive market". Reuters. 15 May 2018. Archived from the original on 29 September 2018. Retrieved 30 January 2022.

- 1 2 "İşte köprü gerçekleri". Hurriyet (in Turkish). 2 July 2017. Archived from the original on 20 June 2018. Retrieved 30 January 2022.

- ↑ "A Big Chill Has Silenced Turkey's Market Analysts". Bloomberg.com. Bloomberg. 24 May 2018. Archived from the original on 28 August 2018. Retrieved 30 January 2022.

- 1 2 3 "Turkey nears 'pariah' status over defiance on rates". Financial Times. 31 July 2018. Archived from the original on 26 August 2018. Retrieved 30 January 2022.

- ↑ "Turkey's Bill for Debt-Fueled Economic Growth Starts to Fall Due". Bloomberg News. Bloomberg. 29 March 2018. Archived from the original on 27 September 2018. Retrieved 22 May 2018.

- ↑ "Turkey's external debt stock reaches $453.2B". Anadolu. 30 March 2018. Archived from the original on 21 September 2018. Retrieved 23 May 2018.

- ↑ "Short Term External Debt Statistics" (PDF). Türkiye Cumhuriyet Merkez Bankası (Central Bank of the Republic of Turkey). March 2018. Archived (PDF) from the original on 28 May 2018. Retrieved 30 January 2022.

- ↑ "Securities Statistics" (PDF). Türkiye Cumhuriyet Merkez Bankası (Central Bank of the Republic of Turkey). 18 May 2018. Archived (PDF) from the original on 13 June 2018. Retrieved 30 January 2022.

- ↑ "Turkey unveils 2019–2021 economic programme". TRT World. Archived from the original on 31 October 2018. Retrieved 20 September 2018.

- ↑ "New economic program: Turkey lays out a broad guideline to rebalance economic growth". Daily Sabah. Archived from the original on 21 September 2018. Retrieved 20 September 2018.

- ↑ "The Turkish government presents plan to balance the economy". BBVA. 20 September 2018. Archived from the original on 4 November 2018. Retrieved 4 November 2018.

- ↑ "Turkey unveils plan to stave off economic crisis". Deutsche Welle. Archived from the original on 31 October 2018. Retrieved 31 October 2018.

- ↑ "With high inflation, Turkish lira lacks yield buffer". Reuters. 11 October 2017. Archived from the original on 28 November 2019. Retrieved 23 May 2018.

- ↑ "Lira fällt Richtung Rekordtief". Handelsblatt. 3 November 2017. Archived from the original on 12 September 2019. Retrieved 3 August 2018.

- 1 2 3 "Turkey's leader is helping to crash its currency". Washington Post. 16 May 2018. Archived from the original on 27 July 2018. Retrieved 22 May 2018.

- ↑ "Investors lose their appetite for Turkey". Financial Times. 16 May 2018. Archived from the original on 17 September 2018. Retrieved 22 May 2018.

- ↑ Küçükgöçmen, Ali; Taner, Behiye Selin (11 May 2018). "Turkey's Erdogan calls interest rates "mother of all evil"; lira slides". Reuters. Archived from the original on 19 May 2018. Retrieved 9 June 2018.

- 1 2 Marc Edward Hoffman (25 May 2018). "The unorthodox theory behind Erdogan's monetary policy". Al-Monitor. Archived from the original on 21 January 2021. Retrieved 30 January 2022.

- ↑ "Why Investors Have Become Skittish About Turkey". Bloomberg. 18 May 2018. Archived from the original on 28 November 2019. Retrieved 23 May 2018.

- ↑ "Turkish lira falls further as Erdogan calls for interest rate cuts". Financial Times. 24 November 2016. Archived from the original on 28 November 2019. Retrieved 23 May 2018.

- ↑ Toksabay, Ece; Dolan, David (15 March 2015). "Rise of Turkish Islamic banks chimes with Erdogan's ideals". Reuters. Archived from the original on 28 November 2019. Retrieved 23 May 2018.

- ↑ Alderman, Liz; Rao, Prashant S. (13 September 2018). "Defying Erdogan, Turkey's Central Bank Raises Interest Rates". The New York Times. Archived from the original on 13 September 2018. Retrieved 13 September 2018.

- 1 2 "Turkish lira slides almost 6% in worst week in a decade". Financial Times. 15 June 2018. Archived from the original on 24 June 2018. Retrieved 30 January 2022.

- ↑ Mark Bentley (16 June 2018). "Turkey needs IMF loans after investor confidence undercut". Ahval. Archived from the original on 29 November 2019. Retrieved 30 January 2022.

- ↑ Paul Krugman (24 May 2018). "Turmoil for Turkey's Trump". New York Times. Archived from the original on 28 November 2018. Retrieved 30 January 2022.

- ↑ Samson, Adam (24 August 2023). "Turkey raises interest rates as it steps up decisive shift in economic policy". Financial Times. Retrieved 31 August 2023.

- ↑ "Turkey's central bank raises interest rates again in another sign of normalizing economic policy". Independent. 24 August 2023. Retrieved 31 August 2023.

- ↑ "Investors Bet Against Turkey Banks as Debt Wave Gains Force". Bloomberg News. Bloomberg. 10 April 2018. Archived from the original on 24 June 2018. Retrieved 22 May 2018.

- 1 2 "Turkish Banks Face Rising Pile of Debt-Restructuring Demands". Bloomberg News. Bloomberg. 31 May 2018. Archived from the original on 19 August 2018. Retrieved 30 January 2022.

- 1 2 "Turkey's Bereket Is Said to Begin Sales to Pay $4 Billion Debt". Bloomberg. 5 July 2018. Archived from the original on 11 September 2018. Retrieved 30 January 2022.

- ↑ Mark Bentley (9 June 2018). "'Unethical' Moody's forewarns second wave of Turkish crisis". Ahval. Archived from the original on 12 June 2018. Retrieved 30 January 2022.

- ↑ David P. Goldman (12 June 2018). "Turkey's economic crisis has just begun". Asia Times.

- ↑ Smallwood, Nicholas. "Halkbank: What happens next?". THINK – Economic and Financial Analysis. ING Bank. Archived from the original on 30 January 2022. Retrieved 4 November 2018.

- ↑ "Cash-hungry Turkish banks raise rates to highest since crisis". Ahval. 9 April 2018. Archived from the original on 24 May 2018. Retrieved 23 May 2018.

- 1 2 "Turkey limits real estate commissions, house prices slashed". Ahval. 14 May 2018. Archived from the original on 12 June 2018. Retrieved 30 January 2022.

- ↑ "Turkish house prices lag inflation by 10 percentage points". Ahval. 17 July 2018. Archived from the original on 17 July 2018. Retrieved 30 January 2022.

- ↑ "Turkey current account gap narrows in sign of rebalancing". Ahval. 10 August 2018. Archived from the original on 10 August 2018. Retrieved 30 January 2022.

- ↑ "Turkish current account deficit narrows; lira gains". Ahval News. Archived from the original on 4 November 2018. Retrieved 14 September 2018.

- ↑ Güldem Atabay Şanlı (8 June 2018). "Turkish contraction looms as rates fallout becomes evident". Ahval. Archived from the original on 12 June 2018. Retrieved 30 January 2022.

- ↑ Ishaan Tharoor (19 June 2018). "The quest to defeat Erdogan". Washington Post. Archived from the original on 22 March 2019. Retrieved 30 January 2022.

- ↑ "Meclis önünde kendini yakan işçi konuştu: Oyumu Tayyip'e attım" (in Turkish). Cumhuriyet. Archived from the original on 22 April 2021. Retrieved 22 March 2021.

- ↑ "'Çocuklarım aç' diyerek valilik önünde kendini yakan adam hayatını kaybetti!". Tele1 (in Turkish). Archived from the original on 26 January 2021. Retrieved 22 March 2021.

- 1 2 3 Shafak, Elif. "Family suicides in Turkey speak of a society that has lost hope". The Guardian. Archived from the original on 8 December 2019. Retrieved 9 December 2019.

- 1 2 3 "'Call me Robin Hood': mystery patron pays debts of Istanbul's poor". 18 November 2019. Archived from the original on 22 January 2021. Retrieved 30 January 2022.

- ↑ "Yildiz $7 Billion Restructuring Bid Adds to Turkish Bank Woes". Bloomberg News. Bloomberg. 12 February 2018. Archived from the original on 12 June 2018. Retrieved 22 May 2018.

- ↑ "IMF backed by terrorists has failed in Turkey – adviser". Ahval. 21 February 2018. Archived from the original on 13 June 2018. Retrieved 30 January 2022.

- 1 2 "Rumors of Turkish deputy PM's departure spook markets". Al-Monitor. 5 April 2018. Archived from the original on 9 December 2018. Retrieved 22 May 2018.

- ↑ "Turkey's Dogus in talks with banks on debt restructuring". Reuters. 7 April 2018. Archived from the original on 18 November 2018. Retrieved 22 May 2018.

- ↑ "'Disbelief': Investors in Turkey stunned by Erdogan's fight with markets". Reuters. 15 May 2018. Archived from the original on 9 July 2018. Retrieved 22 May 2018.

- ↑ "Istanbul foreign exchange bureaus close to survive turbulence". Ahval. 23 May 2018. Archived from the original on 7 July 2018. Retrieved 23 May 2018.

- ↑ "Turkey's sectoral confidence goes down in May". Hurriyet Daily News. 25 May 2018. Archived from the original on 31 July 2018. Retrieved 30 January 2022.

- ↑ "Turkey Raises Interest Rates to Halt Slide into Currency Crisis". Bloomberg News. Bloomberg. 23 May 2018. Archived from the original on 23 June 2018. Retrieved 23 May 2018.

- ↑ Matt O'Brien (25 May 2018). "Turkey tried to save its currency. It worked – for a day". Washington Post. Archived from the original on 9 July 2018. Retrieved 30 January 2022.

- ↑ "Turkish central bank simplifies policy; lira gains". Ahval. 28 May 2018. Archived from the original on 12 June 2018. Retrieved 30 January 2022.

- ↑ "Turkish Central Bank says it will complete 'policy simplification'". Hurriyet Daily News. 28 May 2018. Archived from the original on 28 May 2018. Retrieved 30 January 2022.

- ↑ "Turkish economic confidence slumps to lowest in 15 months". Ahval. 30 May 2018. Archived from the original on 12 August 2018. Retrieved 30 January 2022.

- ↑ "Gama refinancing $1.5 billion latest Turkish debt applicant". Ahval. 30 May 2018. Archived from the original on 12 June 2018. Retrieved 30 January 2022.

- ↑ "Turkish Central Bank vows tight policy, warns about risks". Hurriyet Daily News. 31 May 2018. Archived from the original on 12 June 2018. Retrieved 30 January 2022.

- ↑ "PMI posts 46.4 during May". Istanbul Chamber of Industry. 1 June 2018. Archived from the original on 12 March 2020. Retrieved 27 August 2018.

- ↑ "Turkey Inflation Accelerates in May on Weak Currency". Bloomberg. 4 June 2018. Archived from the original on 29 June 2018. Retrieved 30 January 2022.

- ↑ "Lira's Rebound From a Record May Preclude Central Bank Rate Hike". Bloomberg. 5 June 2018. Archived from the original on 12 August 2018. Retrieved 30 January 2022.

- ↑ "Turkish stock market hits lowest since 2008 crisis". Ahval. 6 June 2018. Archived from the original on 12 June 2018. Retrieved 27 August 2018.

- ↑ "Turkey Central Bank Is Latest to Surprise With Big Rate Move". Bloomberg. 7 June 2018. Archived from the original on 23 June 2018. Retrieved 30 January 2022.

- ↑ "Turkish car sales at lowest in 4 years show economic woes". Ahval. 11 June 2018. Archived from the original on 12 June 2018. Retrieved 30 January 2022.

- ↑ "Turkish current account gap widens; portfolio inflows slump". Ahval. 11 June 2018. Archived from the original on 12 June 2018. Retrieved 30 January 2022.

- ↑ "Erdoğan adviser says high growth doesn't cause inflation". Ahval. 13 June 2018. Archived from the original on 13 June 2018. Retrieved 30 January 2022.

- ↑ "Turkish lira slumps on renewed concern over economic policy". Ahval. 13 June 2018. Archived from the original on 8 September 2018. Retrieved 30 January 2022.

- ↑ "Turkish Yields Head for Record While Lira Loses Rate-Hike Boost". Bloomberg News. Bloomberg. 13 June 2018. Archived from the original on 13 June 2018. Retrieved 30 January 2022.

- ↑ Bentley, Mark. "What next for Turkey after currency crisis?". Speaker. Archived from the original on 17 January 2019. Retrieved 4 November 2018.

- ↑ "Erdoğan says will sanction Moody's after it defamed Turkey". Ahval. 14 June 2018. Archived from the original on 15 June 2018. Retrieved 30 January 2022.

- ↑ "Turkish lira weakens, market seems to shrug off Erdogan's comments on Moody's". Reuters. 14 June 2018. Archived from the original on 15 June 2018. Retrieved 30 January 2022.

- ↑ "Turkey's top business group calls for 'urgent' reforms after election". Hurriyet Daily News. 25 June 2018. Archived from the original on 27 June 2018. Retrieved 30 January 2022.

- ↑ "Turkish economic confidence lowest in 18 months". Ahval. 28 June 2018. Archived from the original on 28 June 2018. Retrieved 30 January 2022.

- 1 2 "Banks Are Poised to Take a Majority Stake in Turk Telekom". Bloomberg. 5 July 2018. Archived from the original on 11 September 2018. Retrieved 30 January 2022.

- ↑ "Turkish inflation surges to highest since 2003". Ahval. 3 July 2018. Archived from the original on 3 July 2018. Retrieved 30 January 2022.

- ↑ "Turkish car sales slump, underscoring economic slowdown". Ahval. 3 July 2018. Archived from the original on 3 July 2018. Retrieved 30 January 2022.

- 1 2 "Turkish lira slides towards record as Erdoğan tightens grip". Ahval. 11 July 2018. Archived from the original on 11 July 2018. Retrieved 30 January 2022.

- ↑ "Turkish Lira Slumps as Erdogan Names Son-in-Law as Economy Chief". Bloomberg L.P. 9 July 2018. Archived from the original on 4 April 2019. Retrieved 30 January 2022.

- ↑ Fadi Hakura (20 July 2018). "Turkey Is Heading for Economic Meltdown". TIME. Archived from the original on 24 November 2020. Retrieved 30 January 2022.

- ↑ "Istanbul exchange offices stop selling dollars". Bloomberg L.P. 15 July 2018. Archived from the original on 12 July 2018. Retrieved 30 January 2022.

- ↑ "Lira Heads for Steepest Drop in Almost 10 Years in Week of Drama". Ahval. 12 July 2018. Archived from the original on 14 April 2019. Retrieved 30 January 2022.

- ↑ "Top Turkish steel company seeks bankruptcy protection". Ahval. 19 July 2018. Archived from the original on 19 July 2018. Retrieved 30 January 2022.

- ↑ "Turkish construction firm applies for bankruptcy protection". Ahval. 20 July 2018. Archived from the original on 20 July 2018. Retrieved 30 January 2022.

- ↑ "Turkey's Central Bank leaves policy rate unchanged, lira falls". Hurriyet Daily News. 24 July 2018. Archived from the original on 25 July 2018. Retrieved 30 January 2022.

- ↑ "Turkey Defies Market Expectations for Rate Rise Under Albayrak". Bloomberg. 24 July 2018. Archived from the original on 24 July 2018. Retrieved 30 January 2022.

- ↑ "Turkey dollar bonds hit as central bank shies away from rate hike". Reuters. 24 July 2018. Archived from the original on 24 July 2018. Retrieved 30 January 2022.

- ↑ "Turkey Admits to 3 More Years of Missing Inflation Target". Bloomberg. 31 July 2018. Archived from the original on 1 August 2018. Retrieved 30 January 2022.

- ↑ "Turkey Banks Want Faster Loan Restructuring as Lira Plunge Bites". Bloomberg. 31 July 2018. Archived from the original on 1 August 2018. Retrieved 30 January 2022.

- ↑ "Turkey's Botas hikes natural gas price for power generation by 50 pct". Nasdaq. 31 July 2018. Archived from the original on 1 August 2018. Retrieved 30 January 2022.

- ↑ "Turkish manufacturers signal more bad news for inflation". Ahval. 1 August 2018. Archived from the original on 1 August 2018. Retrieved 30 January 2022.

- ↑ "Turkish inflation accelerates to 15.9 percent". Ahval. 3 August 2018. Archived from the original on 3 August 2018. Retrieved 30 January 2022.

- 1 2 3 "Turkish lira plunges as crisis mounts". Financial Times. 10 August 2018. Archived from the original on 9 September 2018. Retrieved 30 January 2022.

- ↑ "Erdoğan says Turkey will boycott US electronic products". The Guardian. 14 August 2018. Archived from the original on 8 September 2018. Retrieved 30 January 2022.

- ↑ "Turkish banking regulator limits credit card spending". Ahval. 14 August 2018. Archived from the original on 15 August 2018. Retrieved 30 January 2022.

- 1 2 "Turkish lira rallies as Qatar makes $15bn loan pledge". TheGuardian.com. 15 August 2018. Archived from the original on 21 April 2021. Retrieved 30 January 2022.

- 1 2 "Qatar to invest $15 billion in Turkey; source says banks the focus". Reuters. 15 August 2018. Archived from the original on 30 December 2021. Retrieved 30 January 2022.

- ↑ "Turkish manufacturing growth halves in lira slump". Ahval. 16 August 2018. Archived from the original on 16 August 2018. Retrieved 30 January 2022.

- ↑ "Sectoral Confidence Indices, August 2018". Turkish Statistical Institute. 27 August 2018. Archived from the original on 7 January 2020. Retrieved 30 January 2022.

- ↑ Reuters Editorial. "Moody's sounds more alarm over Turkey's banks, downgrades 20 firms". U.S. Archived from the original on 14 January 2019. Retrieved 13 September 2018.

{{cite news}}:|author=has generic name (help) - ↑ "Moody's downgrades 20 financial institutions in Turkey". Moodys.com. 28 August 2018. Archived from the original on 19 October 2018. Retrieved 13 September 2018.

- ↑ "Transfer of Türk Telekom's majority stake to banks approved by Turkish gov't". Hurriyet Daily News. 29 August 2018. Archived from the original on 9 November 2018. Retrieved 30 January 2022.

- ↑ Reid, David (29 August 2018). "Traders dump lira after Turkey's economic confidence hits a nine-year low". CNBC. Archived from the original on 2 March 2019. Retrieved 13 September 2018.

- ↑ "Turkey has dived headfirst into a 'steep' and 'deep' recession". Business Insider France (in French). Archived from the original on 13 September 2018. Retrieved 13 September 2018.

- ↑ Reuters Editorial. "Turkish cenbank's deputy governor Kilimci to resign – sources". U.S. Archived from the original on 13 September 2018. Retrieved 13 September 2018.

{{cite news}}:|author=has generic name (help) - ↑ "Turkish lira tumbles another 5% as deputy bank chief quits". Gulf-Times (in Arabic). 30 August 2018. Archived from the original on 21 September 2018. Retrieved 13 September 2018.

- ↑ "Turkey Central Bank Deputy Governor Quits – Bloomberg Businessweek Middle East". businessweekme.com. Archived from the original on 13 September 2018. Retrieved 13 September 2018.

- ↑ Jones, Dorian. "Turkish Inflation Soars, Fueling Fears of Economic Crisis". VOA. Archived from the original on 20 February 2019. Retrieved 13 September 2018.

- ↑ GmbH, finanzen.net. "Turkey GDP Growth Slows in Q2 | Markets Insider". markets.businessinsider.com. Archived from the original on 13 September 2018. Retrieved 13 September 2018.

- ↑ Kucukgocmen, Ali. "Turkish economic growth dips, lira crisis darkens outlook". U.S. Archived from the original on 23 November 2018. Retrieved 13 September 2018.

- ↑ "Erdogan takes wheel of Turkish wealth fund". Archived from the original on 6 March 2021. Retrieved 13 September 2018.

- 1 2 "Erdogan Names Himself Turkey Wealth Fund Chairman in Shakeup". Bloomberg.com. 12 September 2018. Archived from the original on 13 September 2018. Retrieved 13 September 2018.

- ↑ "Erdogan takes control of Turkey's sovereign wealth fund". Financial Times. 12 September 2018. Archived from the original on 26 September 2019. Retrieved 13 September 2018.

- ↑ "Erdogan Publishes Decree Forcing Contracts in Turkey to Be Made in Liras". Bloomberg.com. 13 September 2018. Archived from the original on 13 September 2018. Retrieved 13 September 2018.

- ↑ "Erdogan Dollar Ban Sows Confusion Ahead of Key Rate Decision". Bloomberg.com. 13 September 2018. Archived from the original on 13 September 2018. Retrieved 13 September 2018.

- ↑ "Turkey's Erdogan Bashes Central Bank Hours Before Rates Decision". Bloomberg.com. 13 September 2018. Archived from the original on 13 September 2018. Retrieved 13 September 2018.

- ↑ "Turkish central bank hikes rates to 24% in bid to stem currency crisis". Financial Times. 13 September 2018. Archived from the original on 25 September 2019. Retrieved 13 September 2018.

- ↑ Butler, Daren (25 October 2021). "Turkish lira dives deeper after Erdogan seeks expulsions". Reuters. Archived from the original on 24 December 2021. Retrieved 25 October 2021.

- ↑ Soylu, Ragip. "Turkish diplomacy with US stopped expulsion of 10 western envoys, sources say". Middle East Eye. Archived from the original on 26 November 2021. Retrieved 26 November 2021.

- 1 2 Koc, Cagan (18 November 2021). "Turkey's Central Bank Delivers Erdogan Another Cut as Lira Burns". Bloomberg News. Archived from the original on 24 November 2021. Retrieved 24 November 2021.

- ↑ Koc, Cagan (21 October 2021). "Turkey's Central Bank Cuts Rates Again at the Lira's Expense". Bloomberg News. Archived from the original on 24 November 2021. Retrieved 24 November 2021.

- ↑ "Erdoğan says Turkey will succeed in 'economic war of independence'". Daily Sabah. 22 November 2021. Archived from the original on 24 November 2021. Retrieved 24 November 2021.

- ↑ Kozok, Firat (22 November 2021). "Erdogan Defends Pursuit of Lower Interest Rates as Lira Sinks". Bloomberg News. Archived from the original on 24 November 2021. Retrieved 24 November 2021.

- ↑ Yuksekkas, Burhan; Tugce, Ozsoy (23 November 2021). "Erdogan Rate Cut Mantra Fuels Worst Lira Streak in 20 Years". Bloomberg News. Archived from the original on 24 November 2021. Retrieved 24 November 2021.

- ↑ Turak, Natasha (23 November 2021). "Turkish lira crashes to 'insane' historic low after President Erdogan sparks sell-off". CNBC. Archived from the original on 23 November 2021. Retrieved 24 November 2021.

- ↑ Butler, Daren; Devranoglu, Nevzat (23 November 2021). "Turkish lira in historic 15% crash after Erdogan stokes fire sale". Reuters. Archived from the original on 24 November 2021. Retrieved 24 November 2021.

- ↑ Miller, Chance (23 November 2021). "Apple halts product sales in Turkey amid economic crisis". 9to5Mac. Archived from the original on 24 November 2021. Retrieved 24 November 2021.

- ↑ "Turkish lira's losses force businesses to reject local currency contracts". Ahval. 23 November 2021. Archived from the original on 24 November 2021. Retrieved 24 November 2021.

- ↑ Merve YİĞİTCAN (23 November 2021). "Çarşı karıştı, hammadde bulunamıyor". Dünya (in Turkish). Archived from the original on 24 November 2021. Retrieved 24 November 2021.

- ↑ Erkoyun, Ezgi; Devranoglu, Nevzat (16 December 2021). "Turkish lira hits new low after Erdogan's latest rate cut". Reuters. Archived from the original on 27 January 2022. Retrieved 20 December 2021.

- ↑ Stubbington, Tommy; Samson, Adam (17 December 2021). "Turkey suspends stock trading as currency strain spreads through markets". Financial Times. Archived from the original on 1 January 2022. Retrieved 20 December 2021.

- ↑ Erkoyun, Ezgi; Devranoglu, Nevzat (20 December 2021). "Lira skids to new low after Erdogan cites Islamic usury". Reuters. Archived from the original on 21 January 2022. Retrieved 20 December 2021.

- ↑ Pitel, Laura (20 December 2021). "Turkish lira resumes slide as Erdogan vows 'no going back' on rate cuts". Financial Times. Archived from the original on 24 December 2021. Retrieved 20 December 2021.

- ↑ Ant, Onur; Kozok, Firat (20 December 2021). "Lira Slides After Erdogan Says Islam Demands Lower Rates". Bloomberg. Archived from the original on 22 January 2022. Retrieved 20 December 2021.

- ↑ Langley, William (22 November 2021). "Turkish lira holds on to gains after week's see-saw ride". Financial Times. Archived from the original on 30 December 2021. Retrieved 30 January 2022.

- ↑ Wong, Marcus; Vizcaino, Maria Elena; Ozsoy, Tugce (22 December 2021). "Turkish Lira Swings After Its Biggest Rally in 38 Years". Bloomberg. Archived from the original on 3 January 2022. Retrieved 30 January 2022.

- ↑ Turak, Natasha (21 December 2021). "Turkish lira whipsaws from historic low after Erdogan announces rescue plan". CNBC. Archived from the original on 25 January 2022. Retrieved 30 January 2022.