Scheduled Banks in India refer to those banks which have been included in the Second Schedule of Reserve Bank of India Act, 1934.[1] Reserve Bank of India (RBI) in turn includes only those banks in this Schedule which satisfy all the criteria laid down vide section 42(6)(a) of the said Act. Banks not under this Schedule are called Non-Scheduled Banks

Facilities

Every Scheduled bank enjoys two types of principal facilities: it becomes eligible for debts/loans at the bank rate from the RBI; and, it automatically acquires the membership of clearing house.[2]

Types of banks

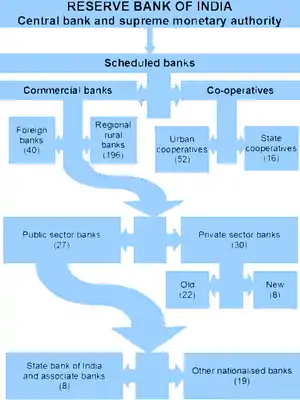

There are two main categories of scheduled banks in India, namely:

- Scheduled Commercial banks

- Scheduled Co-operative banks

Scheduled commercial Banks are further divided into six types, as below:

- Scheduled Public Sector Banks

- Scheduled Private Sector Banks

- Scheduled Small Finance Banks

- Regional Rural Banks

- Foreign Banks

- Payment banks (currently four banks Airtel Payments Bank, Fino Payments Bank, India Post Payments Bank, Paytm Payments Bank have been granted Scheduled bank status).[3][4]

Scheduled Co-operative banks are further divided into 2 types namely:

- Scheduled State Co-operative banks

- Scheduled Urban cooperative banks

See also

References

- ↑ "List of Scheduled Banks by RBI" (PDF). Reserve Bank of India. Retrieved 5 January 2022.

- ↑ "Bharatiya Mahila Bank included in second schedule to RBI Act". Live Mint. 21 May 2014. Retrieved 3 March 2015.

- ↑ https://m.rbi.org.in/scripts/bs_viewcontent.aspx?Id=3657

- ↑ Vanamali, Krishna Veera (13 December 2021). "What does a scheduled bank status mean for Paytm Payments Bank?". Business Standard India. Retrieved 5 January 2022.

Further reading

- "Reserve Bank of India Act, 1934: The Second Schedule" (PDF). Reserve Bank of India. pp. 91–100.