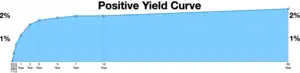

In finance, an inverted yield curve is a yield curve in which short-term debt instruments (typically bonds) have a greater yield than longer term bonds. An inverted yield curve is an unusual phenomenon; bonds with shorter maturities generally provide lower yields than longer term bonds.[2][3]

To determine whether the yield curve is inverted, it is a common practice to compare the yield on the 10-year U.S. Treasury bond to either a 2-year Treasury note or a 3-month Treasury bill. If the 10-year yield is less than the 2-year or 3-month yield, the curve is inverted.[4][5][6]

History

The term "inverted yield curve" was coined by the Canadian economist Campbell Harvey in his 1986 PhD thesis at the University of Chicago.

Causes and significance

There are several explanations of why the yield curve becomes inverted. The "expectations theory" holds that long-term rates depicted in the yield curve are a reflection of expected future short-term rates,[7] which in turn reflect expectations about future economic conditions and monetary policy. In this view, an inverted yield curve implies that investors expect lower interest rates at some point in the future – for example, when the economy is expected to enter a recession and the Federal Reserve reduces interest rates to stimulate the economy and pull it out of recession. In that scenario, expected future short-term rates fall below current short-term rates, and the yield curve inverts.[8][9]

A related explanation holds that when investors who value interest income expect recession, a shift in Federal Reserve policy and lower interest rates, they try to lock in long-term yields to protect their income stream. The resulting demand for longer-term bonds drives up their prices, reducing long-term yields.[9]: 87

Business cycles

The inverted yield curve is the contraction phase in the Business cycle or Credit cycle when the federal funds rate and treasury interest rates are high to create a hard or soft landing in the cycle. When the Federal funds rate and interest rates are lowered after the economic contraction (to get price and commodity stabilization) this is the growth and expansion phase in the business cycle. The Federal Reserve only indirectly controls the money supply and it is the banks themselves that create new money by Fractional-reserve banking when they make loans. By manipulating interest rates with the Federal funds rate and Repurchase agreement (Repo Market) the Fed tries to control how much new money banks create.[10][11]

As a leading indicator

It has often been said that the inverted yield curve has been one of the most reliable leading indicators for economic recession during the post–World War II era. Proponents of this position maintain that inversion tends to predate a recession 7 to 24 months in advance.[2]: 318 [8][12][13][14][15] Others are skeptical, for example stating that the inverted yield curve is "not necessarily" a reliable metric for predicting recession, or that it has predicted "nine of the past five" recessions.[9]: 86 [16]

In 2023, inversion during a labor shortage and low indebtedness raised questions over whether widespread awareness of its predictive power made it less predictive.[17]

Inverted yield curves outside the US

German bonds Inverted yield curve in 2008 and Negative interest rates 2014–2022

30 year

10 year

2 year

1 year

3 month

|

United Kingdom bonds

50 year

20 year

10 year

2 year

1 year

3 month

1 month

|

Canada bonds

30 year

10 year

2 year

1 year

3 month

1 month

|

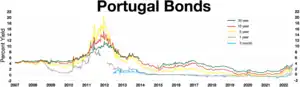

Portugal bonds during European sovereign debt crisis

30 year bond

10 year bond

5 year bond

1 year bond

3 month bond

|

Ireland bond prices, Inverted yield curve in 2011 during European debt crisis and Ireland banking crisis[18] And rates went negative after the European debt crisis

15 year bond

10 year bond

5 year bond

3 year bond

|

Russian bonds, Inverted yield curves to tame inflation during their wars (Russo-Georgian War, Russo-Ukrainian War, 2022 Russian invasion of Ukraine)

20 year bond

10 year bond

1 year bond

3 month bond

|

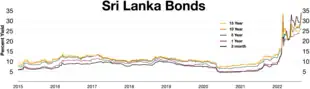

Sri Lanka bonds spiked in 2022 Inverted yield curve in the first half of 2022 during Sri Lankan economic crisis 15 year bonds

10 year bonds

5 year bonds

1 year bonds

6 month bonds

|

Brazilian bonds had an Inverted yield curve starting in August 2014 as part of the 2014 Brazilian economic crisis

10 year bond

5 year bond

1 year bond

|

Iceland bonds had an Inverted yield curve in 2008 during the 2008–2011 Icelandic financial crisis

10 year bonds

5 year bonds

2 year bonds

|

Japan bonds Inverted yield curve in 1990 Zero interest-rate policy starting in 1995 Negative interest rate policy started in 2014 30 year

20 year

10 year

5 year

2 year

1 year

|

New Zealand bonds Inverted yield curve in 1994–1998 and 2004–2008 20 year

10 year

2 year

3 month

1 month

|

See also

- Austrian business cycle theory

- Friedman's k-percent rule

- Zero interest-rate policy

- 1970s commodities boom

- 2000s commodities boom

- 2020s commodities boom

- Sahm rule - Economic indicator predicting recessions

- Yield Curve Control

References

- ↑ "US Treasurys". CNBC. September 25, 2012.

- 1 2 Bodie, Zvi; Kane, Alex; Marcus, Alan J. (2010). Essentials of Investments (Eighth ed.). New York: McGraw-Hill Irwin. p. 315-317. ISBN 978-0-07-338240-1.

- ↑ Melicher, Ronald W.; Welshans, Merle T. Finance: Introduction to Markets, Institutions and Management (7th ed.). Cincinnati OH: South-Western Publishing Co. p. 493. ISBN 0-538-06160-X.

- ↑ "Bond Yields Reliably Predict Recessions. Why?". The Economist. 26 July 2018. Retrieved 31 May 2023.

- ↑ Randall, David; Barbuscia, Davide (March 7, 2023). "Explainer: U.S. yield curve reaches deepest inversion since 1981: What is it telling us?". Reuters. Retrieved 27 May 2023.

- ↑ Strauss, Lawrence C. "Yield-Curve Inversion Widens, Signaling More Recession Worries". Barron's. Dow Jones. Retrieved 28 May 2023.

- ↑ Melicher, Ronald; Welshans, Merle. Finance: Introduction to Markets, Institutions & Management (1988 ed.). Cincinnati OH: South-Western Publishing Co. p. 493. ISBN 0-538-06160-X.

- 1 2 Rosenberg, Joshua; Maurer, Samuel. "Signal or Noise? Implications of the Term Premium for Recession Forecasting". Federal Reserve Bank of New York. Retrieved 27 May 2023.

- 1 2 3 Thau, Annette (2001). The Bond Book (Second ed.). New York: McGraw Hill. p. 86. ISBN 0-07-135862-5.

- ↑ https://mises.org/wire/here-we-go-again-fed-causing-another-recession

- ↑ https://www.newyorkfed.org/markets/reference-rates

- ↑ Campbell, Harvey R. "Yield Curve Inversions and Future Economic Growth" (PDF). Duke University. Retrieved 29 May 2023.

- ↑ "What Is an Inverted Yield Curve?". Investopedia.com.

- ↑ Bruce-Lockhart, Chelsea; Lewis, Emma; Stubbington, Tommy (6 April 2022). "An inverted yield curve: why investors are watching closely". Ig.ft.com.

- ↑ Kock, N., & Tarkom, A. (2023). How many times until a coincidence becomes a pattern? The case of yield curve inversions preceding recessions and the magical number 7, Communications in Statistics-Theory and Methods.

- ↑ Andolfatto, David; Spewack, Andrew (2018). "Does the Yield Curve Really Forecast Recession?". Economic Synopses. 2018 (30). doi:10.20955/es.2018.30. S2CID 158795961. Retrieved 27 May 2023.

- ↑ Darian Woods; Adrian Ma (April 14, 2023). "An indicator that often points to recession could be giving a false signal this time". All Things Considered.

- ↑ "a. Irish yield curve dynamics around 2011 loan amendments. b. Portuguese yield curve around 2011 loan amendments". ResearchGate.

External links

- Daily yield curve data. U.S. Department of the Treasury.

- Daily yield spread data: 10-year vs. 2-year Treasury securities. Federal Reserve Bank of St. Louis.

- Reference Rates. Federal Reserve Bank of New York.

- Here We Go Again: The Fed Is Causing Another Recession. Mises Institute. June 21, 2022.