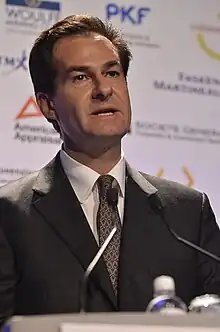

Brian Menell is a South African businessman with interests in mining, agriculture, and banking. He is the CEO and Chairman of TechMet Ltd. London.[1]

Biography

Menell was born in 1965 in Johannesburg.[2] His grandfather, Slip Menell, was the co-founder in 1932 of the Anglovaal Group, one of South Africa's largest diversified mining and industrial groups of companies. His father was the philanthropist and businessman, Clive Menell, who died in 1996.[3] President Nelson Mandela gave the address at Clive's memorial service in Johannesburg.[4]

Menell attended Rugby School in the UK. He holds a BA (Hons) from the University of Pennsylvania in political science and economics.[2]

Career

TechMet

Menell established TechMet, a mining and metals investment company in 2017. The firm is currently based in Dublin but also has offices in London.

The firm is partly supported by the US government's Development Finance Corporation (DFC) who have an estimated 15% stake.

TechMet primarily invests in companies engaged in the mining, processing, and recycling of minerals. Its portfolio includes operations extracting materials like lithium, nickel, and cobalt, which are pivotal components in electric vehicle batteries, as well as rare earth metals used in motors and wind turbines. The company's investment strategy focuses on either selling its stakes or pursuing initial public offerings as evidenced by previous investments like Li-Cycle, a battery recycling entity.

Notably, TechMet is the largest external shareholder in Cornish Lithium, having invested $30 million in the venture, which is formulating plans to mine lithium in the vicinity of St Austell and extract it from geothermal waters near Redruth, Cornwall. The UK Infrastructure Bank have also backed the project.

TechMet is reported to have invested in ten companies. Its interests include nickel and cobalt mining in Brazil and chemical production in Arkansas. Additionally, the firm has stakes in tin and tungsten mining operations in Rwanda.[5]

Mining

Prior to joining Anglovaal Group, Menell worked for the De Beers Group in London, Antwerp and Windhoek for eight years.[6] He originally joined the company as a diamond sorter.[7]

Menell was Principal and Executive Director of Anglovaal Mining Ltd. which owned precious metal, base metal, ferrous metal, and diamond interests across Southern Africa. Menell and his brother, Rick, retained control of Anglovaal until its sale in 2001 to create the largest South African empowerment controlled company, African Rainbow Minerals.[8] During his time with Anglovaal he was also a 50% partner in the Venetia diamond mine.[9] De Beers' acquisition of Anglovaal's interest in the mine for $600 million was the largest in the company's history.[9]

Since the sale of Anglovaal, Menell has been a participant in different projects and businesses across sub-Saharan Africa.

In 2017, Menell founded and continues to serve as chairman and CEO of TechMet Ltd,[10] an investment vehicle for a portfolio of technology metal projects.[11] TechMet acquires and manages projects that produce, process, and recycle the key strategic technology metals that go into batteries, electric vehicles, and robotics – cobalt, lithium, nickel, tin, tungsten, rare earth metals, vanadium, and graphite.

Menell is the chief executive officer of the Kemet Group, which invests in and manages mining and other natural resource projects across the African continent, and advises certain African governments on resource policy and major transactions. He also serves as Chief Executive of Tinco Investments Limited (an integrated tin and tungsten producer).

Menell is a former Director and Chairman of Shore Gold Inc.,[12] one of Canada's largest diamond exploration companies.[13]

Other ventures

In 2004, Menell was a founding partner and Executive Director of the A1 Grand Prix auto racing series.[14] He is a Director and Chairman of Sallfort Partners AG, a private banking joint venture headquartered in Zurich.[15]

Through the SG Menell Charitable Fund, Menell invests in disadvantaged communities in both South Africa and the rest of the developing world.[16]

Menell has been quoted in Bloomberg and the Financial Times on technology metals,[11][17] and in the Financial Times as an expert on the diamond industry, African resources, African politics, and resource nationalism.[18] He has spoken at The Times CEO Summit,[19] The Mines and Money Conference,[20][21] and The New York Africa Forum.[22]

Personal life

He is married with two children. His wife, Emma Menell is the founding Director of Tyburn Gallery in London, UK.[23][7]

References

- ↑ Chowdhury, Hasan (22 April 2019). "US government taps UK firm to secure rare metals". The Telegraph. ISSN 0307-1235. Retrieved 24 June 2020.

- 1 2 "About". Brian Menell Group. Retrieved 24 October 2016.

- ↑ Hansel, Saul (25 July 1996). "Clive S. Menell, 65, Mining Executive In South Africa". The New York Times. Retrieved 12 June 2020.

- ↑ "Nelson Mandela's Speech at The Memorial Service of Clive Menell" Archived December 17, 2013, at the Wayback Machine

- ↑ Gosden, Emily (11 September 2023). "Cornish Lithium investor canters towards becoming $1bn 'unicorn'". The Times. Retrieved 11 September 2023.

- ↑ "Shore Gold appoints former Anglovaal, De Beers man Mennell chair". Mining Weekly. Retrieved 14 October 2016.

- 1 2 "Mining Personality- Brian Menell". Kemet Group. Archived from the original on 25 October 2016. Retrieved 24 October 2016.

- ↑ "Brian Menell Group Business". Brian Menell Group. Retrieved 14 October 2016.

- 1 2 "Shore Gold appoints former Anglovaal, De Beers man Mennell chair". Mining Weekly. Retrieved 14 October 2016.

- ↑ "Home". TechMet Ltd. Retrieved 22 October 2022.

- 1 2 Biesheuvel, Thomas (1 November 2018). "Mining Veteran Wants to Build a $1 Billion Battery Metals Giant". Bloomberg. Retrieved 4 December 2018.

- ↑ Creamer, Martin. "Brian Menell". Mining Weekly.

- ↑ "Resource World" (PDF). Resource World. Archived from the original (PDF) on 25 October 2016. Retrieved 24 October 2016.

- ↑ "South Africa: "A1 Grand Prix: SA Sar Unveiled"". Archived from the original on 28 February 2009. Retrieved 10 August 2010.

- ↑ "Sallfort Partners AG". Moneyhouse. Retrieved 18 October 2016.

- ↑ "Brian Menell Charity". Brian Menell Group. Retrieved 18 October 2016.

- ↑ Sanderson, Henry (7 November 2018). "Cobalt shares rally after Glencore shocks market with sudden sales halt". Financial Times. Retrieved 9 January 2019.

- ↑ Thomas, Helen (17 August 2012). "Shifting ground rocks diamond industry". Financial Times. Retrieved 9 January 2019.

- ↑ "Brian Menell Discusses Foreign Investment in Africa at the Times Africa CEO Summit Part 2". Youtube. Archived from the original on 21 December 2021. Retrieved 18 October 2016.

- ↑ "Brian Menell Keynote Speech Mines and Money Conference Part1". Youtube. Archived from the original on 21 December 2021. Retrieved 18 October 2016.

- ↑ "Brian Menell Keynote Speech Mines and Money Conference Part2". Youtube. Archived from the original on 21 December 2021. Retrieved 18 October 2016.

- ↑ "Brian Menell Talks About the Future of Post Oil at the New York Forum Africa". YouTube. 1 August 2016. Archived from the original on 21 December 2021. Retrieved 9 January 2019.

- ↑ Gerlis, Melanie (3 March 2019). "Demand is high for contemporary African art". Financial Times. Retrieved 11 June 2020.