In economics, the consumption function describes a relationship between consumption and disposable income.[1][2] The concept is believed to have been introduced into macroeconomics by John Maynard Keynes in 1936, who used it to develop the notion of a government spending multiplier.[3]

Details

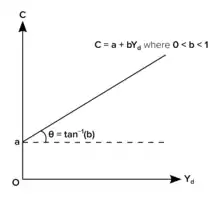

Its simplest form is the linear consumption function used frequently in simple Keynesian models:[4]

where is the autonomous consumption that is independent of disposable income; in other words, consumption when disposable income is zero. The term is the induced consumption that is influenced by the economy's income level . The parameter is known as the marginal propensity to consume, i.e. the increase in consumption due to an incremental increase in disposable income, since . Geometrically, is the slope of the consumption function.

Keynes proposed this model to fit three stylized facts:[5]

- People typically spend a part, but not all of their income on consumption, and they save the rest. They typically do not borrow money to spend, or borrow money to save.[6] This fact is modelled by requiring .

- People with higher income save a higher proportion of the income. This is modelled by decreasing with .

- People, when deciding how much to save, are insensitive to the interest rate.[6]

By basing his model in how typical households decide how much to save and spend, Keynes was informally using a microfoundation approach to the macroeconomics of saving.[7]

Keynes also took note of the tendency for the marginal propensity to consume to decrease as income increases, i.e. .[8] If this assumption is to be used, it would result in a nonlinear consumption function with a diminishing slope. Further theories on the shape of the consumption function include James Duesenberry's (1949) relative consumption expenditure,[9] Franco Modigliani and Richard Brumberg's (1954) life-cycle hypothesis, and Milton Friedman's (1957) permanent income hypothesis.[10]

Some new theoretical works following Duesenberry's and based in behavioral economics suggest that a number of behavioural principles can be taken as microeconomic foundations for a behaviorally-based aggregate consumption function.[11]

See also

Notes

- ↑ Algebraically, this means where is a function that maps levels of disposable income —income after government intervention, such as taxes or transfer payments—into levels of consumption .

- ↑ Lindauer, John (1976). Macroeconomics (Third ed.). New York: John Wiley & Sons. pp. 40–43. ISBN 0-471-53572-9.

- ↑ Hall, Robert E.; Taylor, John B. (1986). "Consumption and Income". Macroeconomics: Theory, Performance, and Policy. New York: W. W. Norton. pp. 63–67. ISBN 0-393-95398-X.

- ↑ Colander, David (1986). Macroeconomics: Theory and Policy. Glenview: Scott, Foresman and Co. pp. 94–97. ISBN 0-673-16648-1.

- ↑ Mankiw, N. Gregory (2022). Macroeconomics (11 ed.). New York. 20-1 What Determines Consumer Spending?. ISBN 978-1-319-26390-4. OCLC 1289514240.

{{cite book}}: CS1 maint: location missing publisher (link) - 1 2 Keynes, John M. (1936). The General Theory of Employment, Interest and Money. New York: Harcourt Brace Jovanovich. Section 3.8.2.

There are not many people who will alter their way of living because the rate of interest has fallen from 5 to 4 per cent, if their aggregate income is the same as before... the short-period influence of the rate of interest on individual spending out of a given income is secondary and relatively unimportant, except, perhaps, where unusually large changes are in question.

- ↑ Solow, Robert M. (2004). "Introduction: The Tobin Approach to Monetary Economics". Journal of Money, Credit, and Banking. 36 (4): 657–663. doi:10.1353/mcb.2004.0067. ISSN 1538-4616. S2CID 154008365.

... recall Keynes's argument that the marginal propensity to consume should be between zero and one, or his discussion about whether the marginal efficiency of investment should be sensitive to current output or should depend primarily on "the state of long-term expectations." Those are microfoundations.

- ↑ Keynes, John M. (1936). The General Theory of Employment, Interest and Money. New York: Harcourt Brace Jovanovich.

The marginal propensity to consume is not constant for all levels of employment, and it is probable that there will be, as a rule, a tendency for it to diminish as employment increases; when real income increases, that is to say, the community will wish to consume a gradually diminishing proportion of it.

- ↑ Duesenberry, J. S. (1949). Income, Saving and the Theory of Consumer Behavior.

- ↑ Friedman, M. (1957). A Theory of the Consumption Function.

- ↑ d’Orlando, F.; Sanfilippo, E. (2010). "Behavioral foundations for the Keynesian consumption function" (PDF). Journal of Economic Psychology. 31 (6): 1035. doi:10.1016/j.joep.2010.09.004.

Further reading

- Poindexter, J. Carl (1976). "The Consumption Function". Macroeconomics. Hinsdale: Dryden Press. pp. 113–141. ISBN 0-03-089419-0. (Undergraduate level discussion of the subject.)

- Sargent, Thomas J. (1979). "The Consumption Function". Macroeconomic Theory. New York: Academic Press. pp. 298–323. ISBN 0-12-619750-4. (Graduate level discussion of the subject.)