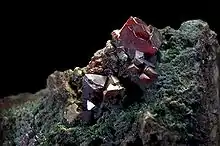

Cuprite with malachite - Dikuluwe Mine | |

| Location | |

|---|---|

Dikuluwe Mine Mine de Dikuluwe | |

| Province | Lualaba Province |

| Country | Democratic Republic of the Congo |

| Coordinates | 10°44′41″S 25°21′45″E / 10.744608°S 25.362625°E |

| Production | |

| Products | Copper: 155,630 tons (2020)[1] Cobalt: 886 tons (2020)[1] |

| Owner | |

| Company | Chinese consortium (68%) Gécamines (32%) |

| Website | www |

The Dikuluwe Mine (French: Mine de Dikuluwe) is a copper and cobalt mine near to Kolwezi in Lualaba Province of the Democratic Republic of the Congo. Dikuluwe is the westernmost of the Dima Pit group, with Mashamba West and Mashamba East. The quarry was opened in 1975 and was planned to be connected to the nearby Mashamba West pit.[2] The combined Dikuluwe and Mashamba West deposits are now run by La Sino-Congolaise des Mines SA (Sicomines), a joint venture majority owned by a Chinese consortium, with Gécamines holding a minority stake.

Katanga Mining had the license to mine copper ore in the mine, but was not planning to open it for production until 2023.

Sicomines reorganization

On September 17, 2007 a memorandum of understanding was drawn up between a Chinese consortium headed by China Railway and the Congolese state, represented by Pierre Lumbi. This agreement concerned $6.565 billion in infrastructure, but did not specify the amount of investment in the mining concessions.[3][4] Projects included in the first phase of $3 billion in funding include a 3,400 km highway between Kisangani and Kasumbalesa and a 3,200 km railway from Katanga to the port of Matadi.[5]

In February 2008 Katanga Mining signed an agreement where the Mashamba West and Dikuluwe deposits were transferred to the state-owned Gécamines. In return, Gécamines would replace these deposits with deposits of similar value or pay US$825 million.[6]

A consortium of the Chinese companies China Railway Engineering Corporation, Sinohydro Corporation, and Zhejiang Huayou Cobalt acquired 68% of the property, with the Congolese state-owned Gécamines and Simco holding 32%.[7] In exchange for ownership of the property, the Chinese consortium agreed to invest about $6bn in infrastructure, and $3bn into this and other mining deposits in the DRC funded by a loan from the Exim Bank of China to be paid back from future profits from the mine.[8] The deal has been widely cited as a prototypical example of an resources-for-infrastructure agreement, and one of the most prominent examples of Chinese projects in Africa.[7][3][9]

The International Monetary Fund was concerned the debt from the deal would create an unsustainable debt load for the DRC, as the deal was made at the same time the DRC was looking to qualify for financial assistance under the heavily indebted poor countries program. This prompted the scope of the deal to be renegotiated in 2009, from a $9 billion deal down to $6 billion.[10]

In early 2012, the China Exim Bank pulled out as a financier of the deals, taking over the Congolese stake and forcing the Chinese side to mortgage their interest in the mine until $1 billion of already disbursed loans were repaid. However, prompted by competition from the China Development Bank and Bank of China, China Exim bank eventually resumed financing the project.[11]

Production at the mines resumed in 2015, but the project was forced to reduce its planned output due to a lack of available electricity.[12]

In November 2016, Zambia announced that they would be implementing a 7.5% duty on copper concentrate imports beginning in 2017. As Sicomines was exporting its copper to Zambian smelters, the policy was predicted to cause disruptions as Sicomines' main alternative would be shipping the concentrate all the way to China through the port of Durban in South Africa.[13] Zambia then scuttled the plan, due to fears the tax would reduce copper concentrate imports.[14]

In September 2017, DRC Mines minister Martin Kabwelulu wrote to Sicomines saying he disapproved of their practice of shipping unprocessed copper concentrate and cobalt hydroxide rather than copper cathodes and cobalt metal. Kabwelulu demanded that Sicomines export only the processed metal, so it could pay off billions of dollars in infrastructure.[15] This export ban was quickly lifted, without explanation.[16]

In 2021, the Extractive Industries Transparency Initiative (EITI) was drafting a report regarding the 2008 agreement, which was sharply critical of its terms.[17] In advance of the report's release, Sicomines criticized EITI organization as ignorant and non objective.[18]

In November 2021, a leak of financial documents from the BGFIBank Group, known as the Congo Hold-Up, revealed the transfer of $25 million from Sicomines to the Congo Construction Co. (CCC) which passed the money to associates of Joseph Kabila.[19][20]

See also

References

- 1 2 Michael J Kavanagh (2021-09-28). "Congo Reviews $6.2 Billion China Mining Deal as Criticism Grows". Bloomberg. Retrieved 2022-08-06.

- ↑ "Main mining sites in Katanga". GECO. Retrieved 2011-11-12.

- 1 2 Landry, David (2018). "The risks and rewards of resource-for-infrastructure deals: Lessons from the Congo's Sicomines agreement". Resources Policy. Elsevier BV. 58: 165–174. doi:10.1016/j.resourpol.2018.04.014. hdl:10419/248201. ISSN 0301-4207.

- ↑ République démocratique du Congo: Ministere des Infrastructures, Travaux Publics et Reconstruction (2007-09-17). "Protocole D'Accord" (pdf) (in French). Carter Center. Retrieved 2022-08-21.

- ↑ "China opens coffers for minerals". BBC News. 2007-09-18. Retrieved 2022-08-21.

- ↑ "Katanga Announces Agreement on Transfer of Mashamba West and Dikuluwe Deposits". Katanga Mining. Feb 8, 2008. Archived from the original on February 1, 2013. Retrieved 2011-11-12.

- 1 2 Jansson, Johanna (2013). "The Sicomines agreement revisited: prudent Chinese banks and risk-taking Chinese companies". Review of African Political Economy. Informa UK Limited. 40 (135): 152–162. doi:10.1080/03056244.2013.762167. ISSN 0305-6244.

- ↑ Barry Sergeant (10 Feb 2008). "DRC/Chinese/Katanga Mining copper/cobalt deal explained". Mine web. Archived from the original on 2012-06-12. Retrieved 2011-11-12.

- ↑ Xu, Jingwei (2020). "Chinese Resource-for-Infrastructure (RFI) Investments in Sub-Saharan Africa and the Future of the "Rules-Based" Framework for Sovereign Finance: The Sicomines Case Study". Michigan Journal of International Law. University of Michigan Law Library (41.3): 615. doi:10.36642/mjil.41.3.chinese. ISSN 2688-5522.

- ↑ Hubert, Thomas (2009-10-08). "Chinese companies sign $6 billion Congo deal". Reuters. Retrieved 2022-08-11.

- ↑ Jansson, Johanna (2014-08-04). "China - DRC Sicomines deal back on track". The Africa Report.com. Retrieved 2022-08-11.

- ↑ Ross, Aaron (2015-07-09). "China's 'infrastructure for minerals' deal gets reality-check in Congo". Reuters. Retrieved 2022-08-11.

- ↑ Burton, Melanie (2016-11-25). "Zambia copper concentrate duty to disrupt global copper supplies-sources". Reuters. Retrieved 2022-08-11.

- ↑ Patson Phiri (2017-02-14). "7.5% duty waiver: Mines see hope". Zambia Daily Mail. Retrieved 2022-08-11.

- ↑ William Clowes (2017-10-08). "Congo Halts Sicomines Copper Exports, Orders Local Refining". Bloomberg. Retrieved 2022-08-11.

- ↑ "Congo lifts ban on raw metal exports by Chinese joint venture". Reuters. 2017-10-11. Retrieved 2022-08-11.

- ↑ Ross, Aaron; Reid, Helen (2021-10-08). "Congo's $6 bln China mining deal 'unconscionable', says draft report". Reuters. Retrieved 2022-08-06.

- ↑ Olander, Eric (2021-10-08). "DRC: Sicomines trying to get ahead of transparency report". The Africa Report.com. Retrieved 2022-08-06.

- ↑ Michael J Kavanagh and William Clowes (2021-11-28). "China Cash Flowed Through Congo Bank to Former President's Cronies". Bloomberg. Retrieved 2022-08-11.

- ↑ Fabricius, Peter (2021-12-06). "SENTRY REPORT: Chinese infrastructure-for-minerals project in DRC derailed by high-level corruption". Daily Maverick. Retrieved 2022-08-11.