Brazilian industry has its earliest origin in workshops dating from the beginning of the 19th century. Most of the country's industrial establishments appeared in the Brazilian southeast (mainly in the provinces of Rio de Janeiro, Minas Gerais and, later, São Paulo), and, according to the Commerce, Agriculture, Factories and Navigation Joint, 77 establishments registered between 1808 and 1840 were classified as "factories" or "manufacturers". However, most, about 56 establishments, would be considered workshops by today's standards, directed toward the production of soap and tallow candles, snuff, spinning and weaving, foods, melting of iron and metals, wool and silk, amongst others. They used both slaves and free laborers.[1]

There were twenty establishments that could be considered in fact manufacturers, and of this total, thirteen were created between the years 1831 and 1840. All were, however, of small size and resembled large workshops more than proper factories. Still, the manufactured goods were quite diverse: hats, combs, farriery and sawmills, spinning and weaving, soap and candles, glasses, carpets, oil, etc. Probably because of the instability of the regency period, only nine of these establishments were still functioning in 1841, but these nine were large and could be considered to "presage a new era for manufactures".[2]

The advent of manufacturing before the 1840s was extremely limited, due to the self-sufficiency of the rural regions, where farms producing coffee and sugar cane also produced their own food, clothes, equipment, etc., the lack of capital, and high costs of production that made it impossible for Brazilian manufacturers to compete with foreign products. Costs were high because most raw materials were imported, even though some of the plants already used machines.[3]

From a colony whose aim was to export primary goods (sugar, gold and cotton), Brazil has managed to create a diversified industrial base in the 20th century. The steel industry is a prime example of that, with Brazil being the 9th largest producer of steel in 2018,[4] and the 5th largest steel net exporter in 2018.[5] Gerdau is the largest producer of long steel in the Americas, owning 337 industrial and commercial units and more than 45,000 employees across 14 countries. Brazil is also a key player in the aircraft market: Embraer is the third largest producer of civil aircraft right after Boeing and Airbus.[6]

1840s–1860s

The promulgation of the Alves Branco Tariff modified this picture. This tariff succeeded in increasing state revenues and stimulating the growth of national industry.[7][8] The sudden proliferation of capital was directed to investments in urban services, transports, commerce, banks, industries, etc.[9] Most of the capital invested in industry was directed toward textiles.[10] With unprecedented industrial growth, multiple manufacturing establishments appeared, dedicated to such diverse products as smelting of iron and metal, machinery, soap and candles, glasses, beer, vinegar, gallons of gold and silver, shoes, hats and cotton fabric.[11]

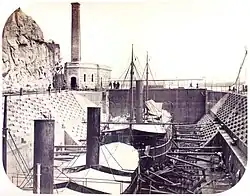

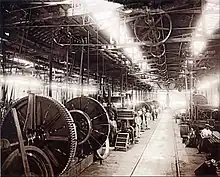

One of the main establishments created at this period was the metallurgical factory Ponta da Areia (in English: Sand Tip), in the city of Niterói, that also constructed steamships.[12] It is likely that the textile industry benefited most by the virtue of being the oldest in the country. It first appeared in 1826, in the city of Recife, capital of the province of Pernambuco.[13] The textile sector was quite dynamic in the monarchic period and received large investments until 1890, when it entered into decline. Various modernizations occurred, principally between 1840 and 1860, when factories with a high level of technological capability were created, able to compete with other major international centers. Other improvements came with the establishment of factories and forges geared for the production of equipment and pieces for textile manufacture.[14] And now Brazil ranks second in the world's largest producer of denim, the third – for the production of knitted fabrics, the fifth – for the manufacture of clothing and seventh – for the production of yarns and fibers. The concentration of industry that emerged in the province of Bahia considerably expanded its economic scope, reaching the south of Ceará, Piauí and even Minas Gerais.[15]

The extinction of the traffic in African slaves in 1850, contrary to what many authors allege, did not "liberate" credit for industrial development. That claim has no documentary basis whatever.[16] On the contrary, capital employed in the trade had already been directed to sectors such as enterprises of urban services, transport, banking and trade. But it is possible that there was an indirect contribution to the growth of the industrial sector through banking loans.[17] In 1850, there were 50 factories with a capital of at least Rs 7.000:000$000.[18]

The imperial government created several incentives for the industrialization of the country. The earliest of these date from the reign of Dom Pedro I, through awards of government grants. The first establishment to receive such a grant was the Fábrica das Chitas (in English: Chitas Factory), devoted to paper and printing, by a decree of 26 June 1826.[19] The practice was resumed in the 1840s, when new industrial establishments received subsidies. in 1857, seven factories benefited from this practice of incentives, among them, the Ponta da Areia mentioned above and that was owned by Irineu Evangelista de Sousa (later Viscount of Mauá). One of the criteria for the granting of these subsidies was the exclusive employment of free workers.[20]

The goal, then, was not only the transition from the old colonial economic system to that of the modern capitalist, but also from slave labor to free. Other incentives arose, such as the decree of 8 August 1846 that exempted manufactured products from certain transport taxes (internally as well as externally), shielded from military recruitment a specific number of employees of industrial establishments and eliminated tariffs on parts and machinery imported for textile factories. The following year in June, a new decree stated that all industrial establishments on national soil would be free of taxes on imported raw materials.[12][21] Thus, production costs of domestic industry dropped considerably, allowing it to compete with foreign products. The Alves Branco tariff underwent modification in 1857, reducing to 15% the tax on imported products.[22][23] Later, under the Rio Branco cabinet at the beginning of the 1870s, the tariff on foreign products was newly raised to 40%, and new raw materials were exempted from import taxes.[23]

1860s–1880s

At the end of the 1860s, came a new industrial surge caused by two armed conflicts: the American Civil War and the Paraguayan War. U.S. production of cotton was interrupted by the blockade by Union forces of the Confederacy. The second resulted in the emission of currency and an increase in import tariffs to cover the costs of war. This resulted in a great stimulus not only for the textile industry, but also for other sectors, such as chemicals, cigars, glass, paper, leather, and optical and nautical instruments.[16]

During the 1870s, the decline of the coffee region of the Paraíba Valley and in some areas of sugar production, caused many plantation owners to invest not only in the cotton textile industry, but also in other manufacturing sectors. Deployment of a railway network throughout the national territory also stimulated the emergence of new industrial activities, mainly in São Paulo.[24] Industry experienced a major impetus in this period. From the 1870s onward, the great expansion of industrialization became a constant in Brazil.[25] In 1866, there were nine textile factories with 795 workers.[26] In 1881, there were 46 textile factories through the country: 12 in Bahia; 11 in Rio de Janeiro; nine in São Paulo; nine in Minas Gerais; and five in other provinces.[27] The number of establishments diminished a little by 1885 to 42 textile factories with 3,172 workers. However, the drop did not impede overall growth in the sector up to 1889.[26]

In 1880 the Industrial Association was established, with its first board elected the following year. It supported new industrial incentives and propagandized against the defenders of an essentially agricultural Brazil.[28] 9.6% of the capital of the Brazilian economy was directed to industry by 1884, and by 1885, 11.2%. This figure dropped sharply during the republican period, falling to 5% between 1895 and 1899, and improved slightly to 6% between 1900 and 1904. Still, it took many years to return to the level that prevailed during the Empire.[29] At the time of its downfall in 1889, monarchical Brazil had 636 factories (representing an annual rate of increase of 6.74% from 1850) with a capital of Rs 401.630:600$000 (annual growth rate of 10.94% since 1850).[18] Of this amount, 60% were employed in the textile sector, 15% in food, 10% in the chemical, 4% in timber, 3.5% in clothing and 3% in metallurgy.[30]

Brazilian industrial sector

Most large industry is concentrated in the south and south east. The north east is traditionally the poorest part of Brazil, but it is beginning to attract new investment.

Brazil has the third best advanced industrial sector in The Americas. Accounting for one-third of GDP, Brazil's diverse industries range from automobiles, steel and petrochemicals to computers, aircraft, and consumer durables. With the increased economic stability provided by the Plano Real, Brazilian and multinational businesses have invested heavily in new equipment and technology, a large proportion of which has been purchased from U.S. firms.

Brazil has a diverse and sophisticated services industry as well. During the early 1990s, the banking sector accounted for as much as 16% of GDP. Although undergoing a major overhaul, Brazil's financial services industry provides local businesses with a wide range of products and is attracting numerous new entrants, including U.S. financial firms. The São Paulo and Rio de Janeiro stock exchanges are undergoing a consolidation and the reinsurance sector is about to be privatized.

In 2019, Brazil's secondary (industrial) sector represented only 11% of Brazil's economic activity. In the 1990s, activity accounted for more than 15% of GDP. In 1970, the participation was 21.4%. The Brazilian industry is one of those that showed the most decline in the world in almost 50 years. The deindustrialization of the Brazilian economy is very particular and happened very early, as it is normal for the industry to lose space when the per capita income of families starts to grow, since they consume more services and less goods, however, in Brazil, they do not a high per capita income was reached and the country did not get rich enough for the productive structure to migrate so quickly. With that, the country is stuck. The stagnation of the sector partly explains the slow resumption of the labor market in the country. The solution to the problem, according to experts, would be more financing mechanisms, solving bottlenecks in the national infrastructure and in the tax system to leverage the industry again and make Brazil more competitive. Brazil is the ninth industrial park in the world.[31]

In 2017, the Southeast was responsible for 58% of the value of industrial transformation in Brazil, followed by the South (19.6%), Northeast (9.9%), North (6.9%) and Midwest (5.6%).[32]

In Brazil, the automotive sector represents close to 22% of industrial GDP. The ABC Region in São Paulo is the first center and largest automobile hub in Brazil. When the country's manufacturing was practically restricted to ABC, the State accounted for 74.8% of Brazilian production in 1990. In 2017, this index decreased to 46.6%, and in 2019, to 40.1%, due to a phenomenon of internalization of the production of vehicles in Brazil, driven by factors such as unions, which made the payroll and labor charges excessive, discouraged investments and favored the search for new cities. The development of ABC cities has also helped to curb attractiveness, due to rising real estate costs, and a greater density of residential areas. The area around Porto Real, in Rio de Janeiro was already the second largest pole in 2017, but in 2019 it fell to 4th place, behind Paraná (15%) and Minas Gerais (10.7%). In the Southeast, São Paulo has plants from GM, Volkswagen, Ford, Honda, Toyota, Hyundai, Mercedes-Benz, Scania and Caoa. Rio de Janeiro has Nissan, Land Rover, Citroen/Peugeot and MAN plants. Minas Gerais has Fiat and Iveco factories. In the South, Paraná has Volkswagen, Renault, Audi, Volvo and DAF factories; Santa Catarina has GM and BMW plants and Rio Grande do Sul, a GM plant. In the Midwest, Goiás has Mitsubishi, Suzuki and Hyundai factories. In the Northeast, Bahia has a Ford factory and Pernambuco has a Jeep factory.[33][34][35][36] Despite being, in 2018, the eighth largest vehicle producer in the world, Brazil didn't even have a national industry. The last Brazilian industry was Gurgel.[37]

In 2017, the main manufacturers of tractors in Brazil were John Deere, New Holland, Massey Ferguson, Valtra, Case IH and the Brazilian Agrale. All have factories in the Southeast, basically in São Paulo.[38]

The mineral extractive industry represents 15% of the GDP of Rio de Janeiro. In the state, this sector corresponds almost entirely to the exploration and production of oil and gas, which reflects its importance for the economy of Rio de Janeiro. The transformation industry represents 6% of the State's GDP. In 2019, Rio de Janeiro was the largest producer of oil and natural gas in Brazil, with 71% of the total volume produced. São Paulo comes in 2nd place, with an 11.5% share of total production. Espírito Santo was the third largest producer state, with 9.4%.[39][40]

In 2016, substances in the metallic class accounted for about 77% of the total value of Brazilian commercialized mineral production. Among these substances, eight correspond to 98.6% of the value: aluminum, copper, tin, iron, manganese, niobium, nickel and gold. Highlight for the significant participation of iron in this amount, whose production is mainly concentrated in the states of Minas Gerais and Pará. According to the National Department of Mineral Production (DNPM), in 2011 there were 8,870 mining companies in the country, and in the Southeast region, this number reached 3,609, about 40% of the total. In the Southeast region, iron ore, gold, manganese and bauxite, in the Quadrilátero Ferrífero; niobium and phosphate in Araxá; gemstones, in Governador Valadares; and graphite, in Salto da Divisa, all in the state of Minas Gerais; in addition to aggregates, in São Paulo and Rio de Janeiro, and ornamental rocks, in Espírito Santo. The income of the mining sector in Brazil was R$153.4 billion in 2019. Exports were U$32.5 billion. The country's iron ore production was 410 million tons in 2019. Brazil is the second largest global iron ore exporter and has the second position in the reserve ranking: under Brazilian soil there are at least 29 billion tons. The largest reserves are currently in the states of Minas Gerais and Pará. According to data from 2013, Minas Gerais is the largest Brazilian mining state. With mining activity in more than 250 municipalities, and more than 300 mines in operation, the state has 40 of the 100 largest mines in Brazil. In addition, of the 10 largest mining municipalities, seven are in Minas, with Itabira being the largest in the country. It is also responsible for approximately 53% of the Brazilian production of metallic minerals and 29% of the total minerals, in addition to extracting over 160 million tons/year of iron ore. Vale S.A. is the main company active in the production of iron ore in the state. The state is the largest employer in the mineral activity (53,791 workers in 2011). São Paulo, the second largest employer, had 19 thousand employees in the sector this year.[41][42][43] In 2017, in the Southeast Region, the numbers were as follows: Minas Gerais was the country's largest producer of iron (277 million tons at a value of R$37.2 billion), gold (29.3 tons at a value of R$3.6 billion), zinc (400 thousand tons at a value of R$351 million) and niobium (in the form of pyrochlorine) (131 thousand tons at a value of R$254 million). In addition, Minas was the 2nd largest producer of aluminum (bauxite) (1.47 million tons at a value of R$105 million), 3rd of manganese (296 thousand tons at a value of R$32 million) and 5º of tin (206 tons at a value of R$4.7 million). Minas Gerais had 47.19% of the value of mineral production traded in Brazil, with R$41.7 billion.[44][45][46][47] In 2017, in terms of production traded throughout the Northern Region, in the iron ore sector, Pará was the 2nd largest national producer, with 169 million tons (of the 450 million produced by the country), at a value of R$25.5 billion. Amapá produced 91.5 thousand tons. In copper, Pará produced almost 980 thousand tons (of the 1.28 million tons in Brazil), at a value of R$6.5 billion. In aluminum (bauxite), Pará carried out almost all Brazilian production (34.5 of 36.7 million tons) at a value of R$3 billion. In manganese, Pará produced a large part of Brazilian production (2.3 of 3.4 million tons) at a value of R$1 billion. In gold, Pará was the 3rd largest Brazilian producer, with 20 tons at a value of R$940 million. Amapá produced 4.2 tons at a value of R$540 million. Rondônia produced 1 ton at a value of R$125 million. In nickel, Goiás and Pará are the only two producers in the country, with Pará being the 2nd in production, having obtained 90 thousand tons at a value of R$750 million. In tin, the state of Amazonas was the largest producer (14.8 thousand tons, at a value of R$347 million), Rondônia was the 2nd largest producer (10,9 thousand tons, at a value of R$333 million) and Pará the 3rd largest producer (4.4 thousand tons, at a value of R$114 million). There was also production of niobium (in the form of columbita-tantalita) in Amazonas (8.8 thousand tons at R$44 million) and Rondônia (3.5 thousand tons at R$24 million), and zinc in gross form in Rondônia (26 thousand tons at R$27 million). Pará had 42.93% of the value of commercialized mineral production in Brazil, with almost R$38 billion, Amapá had 0.62% of the value, with R$551 million, Rondônia had 0.62% of the value, with R$544 million, Amazonas had 0.45% of the amount with R$396 million, and Tocantins had 0.003% of the amount with R$2.4 million.[44] In the Midwest Region, Goiás stands out, with 4.58% of the national mineral participation (3rd place in the country). In 2017, at nickel, Goiás and Pará are the only two producers in the country, Goiás being the 1st in production, having obtained 154 thousand tons at a value of R$1.4 billion. In copper, it was the 2nd largest producer in the country, with 242 thousand tons, at a value of R$1.4 billion. In gold, it was the 4th largest producer in the country, with 10.2 tons, at a value of R$823 million. In niobium (in the form of pyrochlorine), it was the 2nd largest producer in the country, with 27 thousand tons, at a value of R$312 million. In aluminum (bauxite), it was the 3rd largest producer in the country, with 766 thousand tons, at a value of R$51 million.[44][48] Still in 2017, in the Midwest, Mato Grosso had 1.15% of the national mineral participation (5th place in the country) and Mato Grosso do Sul had 0.71% of the national mineral participation (6th place in the country). Mato Grosso had production of gold (8.3 tons at a value of R$1 billion) and tin (536 tons at a value of R$16 million). Mato Grosso do Sul had production of iron (3.1 million tons at a value of R$324 million) and manganese (648 thousand tons at a value of R$299 million).[44] In Northeast Region, Bahia stands out, with 1.68% of the national mineral participation (4th place in the country). In 2017, at gold, it produced 6.2 tons, at a value of R$730 million. At copper, it produced 56 thousand tons, at a value of R$404 million. At chrome, it produced 520 thousand tons, at a value of R$254 million. In vanadium, it produced 358 thousand tons, at a value of R$91 million.[44]

In steel industry, Brazilian crude steel production was 32.2 million tons in 2019. Minas Gerais accounted for 32.3% of the volume produced in the period, with 10.408 million tons. The other largest steel centers in Brazil in 2019 were: Rio de Janeiro (8.531 million tons), Espírito Santo (6.478 million tons) and São Paulo (2.272 million tons). National production of rolled products was 22.2 million tons, and that of semi-finished products for sales totaled 8.8 million tons. Exports reached 12.8 million tons, or US $7.3 billion. Among the largest steel companies in the Southeast are Gerdau, CSN, Ternium Brasil, Usiminas and Aperam South America.[49]

In the paper and cellulose sector, Brazilian pulp production was 19.691 million tons in 2019. The country exported US $7.48 billion in pulp this year, US $3.25 billion only to China. Brazilian forest-based industry exports totaled US $9.7 billion (US $7.48 billion in cellulose, US $2 billion in paper and US $265 million in wood panels). Paper production was 10.535 million tons in 2019. The country exported 2.163 million tons. In 2016, the paper and cellulose industry in the South of the country represented 33% of the national total. This year, Paraná was the national leader in the production of roundwood (mainly eucalyptus) for the pulp and paper industry (15.9 million m³); Brazil was the second country that produced the most cellulose in the world and the eighth in the production of paper. The city that most produced these woods in Brazil was Telêmaco Borba (PR), and the 5th largest was Ortigueira (PR).[50][51][52] Espírito Santo stands out in this sector. In 2018, U $920 million were traded in the sale of cellulose to the foreign market, the third strongest Espírito Santo product in the export balance. In 2016, the top five states producing logs for paper and cellulose (mainly eucalyptus) were: Paraná (15.9 million m³), São Paulo (14.7 million m³), Bahia (13.6 million m³), Mato Grosso do Sul (9.9 million m³) and Minas Gerais (7.8 million m³). Together, they correspond to 72.7% of the national production of 85.1 million m³. Espírito Santo, 9th place, had a production of 4.1 million m³. São Mateus, in the North of Espírito Santo, was the best placed city in the Southeast, as the 6th largest producer of roundwood for paper and cellulose in the country. The ten largest producing municipalities had 22.9% of the country's production. They were the cities of Telêmaco Borba (PR), Três Lagoas (MS), Caravelas (BA), Mucuri (BA), Ortigueira (PR), São Mateus (ES), Dom Eliseu (PR), Nova Viçosa (BA), Water Clara (MS) and Ribas do Rio Pardo (MS).[53][52]

The shipbuilding sector of Rio de Janeiro is one of the most important in the country, but it has already had two major historical crises: one in the 1980s, when it went bankrupt, and another that started in 2014, both due to the country's economic situation: between 2014 and 2016, the Brazilian shipbuilding industry lost 49% of its employed people. The drop of about 30 thousand vacancies was concentrated in the state of Rio de Janeiro, which closed around 23 thousand jobs in the same period. From 31.2 thousand employed in 2014, the number dropped to just 8 thousand in 2016. The gross real value of industrial production also fell 71%, from R $6.8 billion in 2014, to R $1.97 billion in 2016. However, at the end of 2019, the return of the pre-salt began to re-boost the naval sector: maintenance and repair activities pointed to increased demand for the coming years.[54][55][56]

In 2011, Brazil had the 6th largest chemical industry in the world, with net sales of US $157 billion, or 3.1% of world sales. At that time, there were 973 factories for chemical products for industrial use. They are concentrated in the Southeast Region, mainly in São Paulo. The chemical industry contributed 2.7% to Brazilian GDP in 2012 and established itself as the fourth largest sector in the manufacturing industry. Despite registering one of the largest sales in the sector in the world, the Brazilian chemical industry, in 2012 and 2013, saw a strong transfer of production abroad, with a drop in national industrial production and an increase in imports. One third of consumption in the country was served by imports. 448 products stopped being manufactured in Brazil between 1990 and 2012. This resulted in the stoppage of 1,710 production lines. In 1990, the share of imported products in Brazilian consumption was only 7%, in 2012 it was 30%. The main companies in the sector in Brazil are: Braskem, BASF, Bayer, among others. In 2018, the Brazilian chemical sector was the eighth largest in the world, accounting for 10% of the national industrial GDP and 2.5% of the total GDP. In 2020, imports will occupy 43% of the domestic demand for chemicals. Since 2008, the average use of capacity in the Brazilian chemical industry has been at a level considered low, ranging between 70 and 83%.[57][58][59]

In Food industry, In 2019, Brazil was the 2nd largest exporter of processed foods in the world, with a value of U $34.1 billion in exports. The Brazilian food and beverage industry's revenue in 2019 was R $699.9 billion, 9.7% of the country's Gross Domestic Product. In 2015, the industrial food and beverage sector in Brazil comprised 34,800 companies (not counting bakeries), the vast majority of which were small. These companies employed more than 1,600,000 workers, making the food and beverage industry the largest employer in the manufacturing industry. There are around 570 large companies in Brazil, which concentrate a good part of the total industry revenue. The top 50 were: JBS, Ambev, Bunge, BRF, Cargill, Marfrig, LDC do Brasil, Amaggi, Minerva Foods, Coca Cola Femsa, Aurora, Vigor, M.Dias Branco, Camil Alimentos, Solar.Br, Granol, Caramuru Alimentos, Bianchini, Copacol, Citrosuco, Trustmill, Três Corações Alimentos S.A., Itambé, Ajinomoto, Algar Agro, Piracanjuba, Vonpar, Agrex, Frimesa, GTFoods Group, Grupo Simões, Elebat Alimentos, Garoto, Pif Paf Alimentos, J. Macêdo, Frigol, Josapar, Olfar Alimento e Energia, Embaré, Alibem, Dalia Alimentos, Asa Participações, Cacique, Frisa, Arroz Brejeiro, Gomes da Costa, Pamplona, Moinhos Cruzeiro do Sul, Better Beef, SSA Alimentos and Correcta.[60][61][62]

In Pharmaceutical industry, most companies in Brazil have been based in Rio de Janeiro and São Paulo for a long time. In 2019, the situation was that, due to the tax advantages offered in states like Pernambuco, Goiás and Minas Gerais, companies were leaving RJ and SP, and going to these states. At the time, the more than 110 companies associated with Sinfar-RJ fell to just 49. Rio de Janeiro, at this time, represented the most expensive state for pharmaceutical production, with its ICMS at 20%. Even in 2019, the Rio de Janeiro industrial park had revenues of almost R $8 billion and an 11% share in the Brazilian pharmaceutical market. In the Jacarepaguá neighborhood, there are several pharmaceutical industries, such as GSK, Roche, Merck, Servier and Abbott. In 2017, Brazil was considered the sixth largest pharmaceutical market in the world. Drug sales in pharmacies reached around R $57 billion (US $17.79 billion) in the country. The pharmaceutical market in Brazil had 241 laboratories regularized and authorized for the sale of medicines. Of these, the majority (60%) have national capital. Multinational companies held about 52.44% of the market, with 34.75% in marketed packaging. Brazilian laboratories represent 47.56% of the market in sales and 65.25% in boxes sold. In the distribution of drug sales by state, São Paulo occupied the first position: the São Paulo drug industry had a turnover of R $53.3 billion, 76.8% of total sales across the country. Just behind came Rio de Janeiro, which had revenues of approximately R $7.8 billion. The pharmaceutical industry's exports reached US $1.247 billion in 2017. The companies that most profited from the sale of medicines in the country in 2015 were EMS, Hypermarcas (NeoQuímica), Sanofi (Medley), Novartis, Aché, Eurofarma, Takeda, Bayer, Pfizer and GSK.[63][64]

In the leather-footwear sector (Footwear industry), in 2019 Brazil produced 972 million pairs. Exports were around 10%, reaching almost 125 million pairs. Brazil is in the 4th position among the world producers, behind China (who produces more than 10 billion pairs), India and Vietnam, and in 11th place among the biggest exporters. Of the pairs produced, 49% were made of plastic or rubber, 28.8% were made of synthetic laminate and only 17.7% were made of leather. The largest pole in Brazil is located in Rio Grande do Sul (region of Vale dos Sinos, in 25 cities around Novo Hamburgo). The Brazilian state that most exports the product is Rio Grande do Sul: in 2019 it exported US $448.35 million. The majority of the product goes to United States, Argentina and France. Domestic consumption absorbs a large part of production. The state has or created some of the most important factories in Brazil in the sector. São Paulo has important footwear hubs, such as that of the city of Franca, specialized in men's shoes, in the city of Jaú, specialized in women's shoes and in the city of Birigui, specialized in children's shoes. Jaú, Franca and Birigui represent 92% of the footwear production in the State of São Paulo. Birigui has 350 companies, which generate about 13 thousand jobs, producing 45.9 million pairs per year. 52% of children's shoes in the country are produced in this city. From Birigui came most of the most famous children's shoe factories in the country. Jaú has 150 factories that produce about 130 thousand pairs of women's shoes per day. The footwear sector in Franca has around 550 companies and employs around 20,000 employees. Most of the most famous men's shoe factories in the country came from São Paulo. Minas Gerais has a polo specialized in cheap shoes and falsified tennis in Nova Serrana. The city has about 830 industries, which in 2017 produced around 110 million pairs. However, in general, the Brazilian industry has been struggling to compete with Chinese footwear, which is unbeatable in price due to the difference in tax collection from one country to another, apart from the absence of heavy Brazilian labor taxes in China, and the Brazilian businessman has had to invest in value-added products, combining quality and design, in order to survive.[65][66][67][68][69] Some of the most famous companies in the country are Beira Rio, Grendene, Ortopé, Piccadilly, Usaflex, Vulcabrás,[70] Alpargatas[71] and Rainha.

In Textile industry, Brazil, despite being among the 5 largest producers in the world in 2013, and being representative in the consumption of textiles and clothing, has very little insertion in global trade. In 2015, Brazilian imports ranked 25th in the ranking (US $5.5 billion). And in exports, it was only 40th in the world ranking. Brazil's participation in the world trade in textiles and clothing is only 0.3%, due to the difficulty of competing in price with producers in India and mainly in China. The gross value of production, which includes consumption of intermediate goods and services, by the Brazilian textile industry corresponded to almost R $40 billion in 2015, 1.6% of the gross value of Industrial Production in Brazil. The Southeast has 48.29% of production, the South has 32.65% and the Northeast, 16.2%. Midwest (2.5%) and North (0.4%) are not very representative in this activity. São Paulo (37.4%) is the largest producer. Minas Gerais has 8.51% (3rd largest production in the country, behind Santa Catarina). There are 260 thousand people employed in this activity in the country, 128 thousand in the Southeast. Among the main textile clusters in Brazil, the Vale do Itajaí (SC), the Metropolitan Region of São Paulo (SP) and Campinas (SP) stand out. Together, these three mesoregions are responsible for 36% of formal jobs in this industry. There were 2,983 textile companies in Brazil in 2015. In 2015, Santa Catarina was the 2nd largest textile and clothing employer in Brazil. It occupied the national leadership in the manufacture of pillows and is the largest producer in Latin America and the second in the world in woven labels. It is the largest exporter in the country of toilet / kitchen clothes, cotton terry cloth fabrics and cotton knit shirts.[72] Some of the most famous companies in the region are Hering, Malwee, Karsten and Haco.

In Electronics industry, the turnover of industries in Brazil reached R $153.0 billion in 2019, about 3% of the national GDP. The number of employees in the sector was 234.5 thousand people. Exports were US $5.6 billion, and the country's imports were US $32.0 billion. Brazil, despite its efforts over the decades to get rid of the dependence on technology imports, has not yet managed to reach this level. Imports are concentrated in expensive components, such as processors, microcontrollers, memories, under-mounted magnetic disks, lasers, LED and LCD. Cables for telecommunication and electricity distribution, wires, optical fibers and connectors are manufactured in the country. Brazil has two large electro-electronic production hubs, located in the Metropolitan Region of Campinas, in the State of São Paulo, and in Free Economic Zone of Manaus, in the State of Amazonas. There are large internationally renowned technology companies, as well as part of the industries that participate in its supply chain. The country also has other smaller centers, such as the municipalities of São José dos Campos and São Carlos, in the State of São Paulo; the municipality of Santa Rita do Sapucaí, in the State of Minas Gerais; Recife, capital of Pernambuco; and Curitiba, capital of Paraná. In Campinas there are industrial units from groups such as General Electric, Samsung, HP and Foxconn, a manufacturer of products from Apple and Dell. São José dos Campos, is focused on the aviation industry. This is where the headquarters of Embraer is located, a Brazilian company that is the third largest aircraft manufacturer in the world, after Boeing and Airbus. In Santa Rita do Sapucaí, 8 thousand jobs are linked to the sector, with more than 120 companies. Most produce equipment for the telecommunications industry, such as converters (set-top Box), including those used in the transmission of the digital TV system.[73][74] The technological center of Curitiba has companies such as Siemens and Positivo Informatics. In all, 87 companies and 16 thousand employees work at Tecnoparque, an area of 127 thousand square meters created by state law in 2007. Tecnoparque can grow up to 400 thousand square meters and receive up to four times the number of workers it has today, reaching 68 thousand people.[73]

In the household appliances industry, sales of so-called "white line" equipment (refrigerator, air conditioning and others) were 12.9 million units in 2017. The sector had its peak sales in 2012, with 18.9 million units. The brands that sold the most were Brastemp, Electrolux, Consul and Philips. Brastemp is originally from São Bernardo do Campo-SP. Consul is originally from Santa Catarina, having merged with Brastemp and today being part of the multinational Whirlpool Corporation. Another famous brand from the South was Prosdócimo, founded in Curitiba, which was sold to Electrolux.[75]

In the small appliances sector, Brazil has two famous companies: Arno, which was 70 years in São Paulo, and today its factory is located in Itatiaia-RJ; and Britânia, originally from Curitiba-PR.

.jpg.webp)

In the metallurgical business, the South has one of the most famous companies in the country, Tramontina, originally from Rio Grande do Sul and famous manufacturer of knives, pans, shovels and various utensils, which has more than 8,500 employees and 10 manufacturing units. Other famous companies in the South are Marcopolo, a manufacturer of bus bodies, which had a market value of R $2.782 billion in 2015, and Randon, a group of 9 companies specialized in solutions for the transportation, which brings together manufacturers of vehicles, auto parts, and road equipment - employs around 11,000 people and recorded gross sales in 2017 of R $4.2 billion.

Another important industry, based in Rio de Janeiro, is White Martins, which deals with the manufacture of industrial and medical gases, such as oxygen cylinders. It is a supplier of all Brazilian petrochemical hubs and one of the largest suppliers to the steel industry. The company also has a strong presence in the metal-mechanic, food, beverage, environment and small consumer segment, in the medical-hospital sector and in the natural gas area.

By state and region

.jpg.webp)

Southeast, South and Midwest are responsible for 80% of the national industrial GDP, as shown below:

São Paulo in 2017 had an industrial GDP of R $378.7 billion, equivalent to 31.6% of the national industry and employing 2,859,258 workers in the industry. The main industrial sectors are: Construction (18.7%), Food (12.7%), Chemicals (8.4%), Public Utility Industrial Services, such as Electricity and Water (7.9%) and Motor Vehicles (7.0%). These 5 sectors concentrate 54.7% of the state's industry.[76]

Minas Gerais had in 2017 an industrial GDP of R $128.4 billion, equivalent to 10.7% of the national industry. It employs 1,069,469 workers in the industry. The main industrial sectors are: Construction (17.9%), Extraction of Metallic Minerals (15.2%), Food (13.4%), Industrial Services of Public Utility, such as Electricity and Water (10.8%) and Metallurgy (10.5%). These 5 sectors concentrate 67.8% of the state's industry.[77]

In Rio de Janeiro in 2017 had an industrial GDP of R $104.6 billion, equivalent to 8.7% of the national industry and employing 556,283 workers in the industry. The main industrial sectors in Rio are: Construction (22.6%), Extraction of Oil and Natural Gas (22.3%), Industrial Services of Public Utility, such as Electricity and Water (14.3%), Petroleum Products and Biofuels (14.1%) and Chemicals (3.6%). These 5 sectors concentrate 76.9% of the state's industry.[78]

Paraná had an industrial GDP of R $92.8 billion in 2017, equivalent to 7.8% of the national industry. It employs 763,064 workers in the industry. The main industrial sectors are: Food (19.1%), Industrial Services of Public Utility, such as Electricity and Water (18.5%), Construction (17.3%), Motor Vehicles (8.1%), and Petroleum Derivatives and Biofuels (5.7%). These 5 sectors concentrate 68.7% of the state's industry.[79]

In 2017, Rio Grande do Sul had an industrial GDP of R $82.1 billion, equivalent to 6.9% of the national industry. It employs 762,045 workers in the industry. The main industrial sectors are: Construction (18.2%), Food (15.4%), Industrial Public Utility Services, such as Electricity and Water (9.8%), Chemicals (6.8%), and Machinery and Equipment (6.6%). These 5 sectors concentrate 56.8% of the state's industry.[80]

Santa Catarina had an industrial GDP of R $63.2 billion in 2017, equivalent to 5.3% of the national industry. It employs 761,072 workers in the industry. The main industrial sectors are: Construction (17.9%), Food (15.9%), Clothing (7.4%), Industrial Public Utility Services, such as Electricity and Water (6.9%), and Textiles (6.0%). These 5 sectors concentrate 54.1% of the state's industry.[81]

Goiás had in 2017 an industrial GDP of R $37.1 billion, equivalent to 3.1% of the national industry. It employs 302,952 workers in the industry. The main industrial sectors are: Construction (25.6%), Food (25.2%), Industrial Public Utility Services, such as Electricity and Water (17.2%) and Petroleum Products and Biofuels (7.4%) and Chemicals (3.7%). These 5 sectors concentrate 79.1% of the state's industry.[82]

.jpg.webp)

Espírito Santo in 2017 had an industrial GDP of R $21.3 billion, equivalent to 1.8% of the national industry. It employs 168,357 workers in the industry. The main industrial sectors are: Extraction of Oil and Natural Gas (23.0%), Construction (20.5%), Industrial Services of Public Utility, such as Electricity and Water (12.3%), Metallurgy (7.5%) and Pulp and Paper (6.6%). These 5 sectors concentrate 69.9% of the state's industry.[77]

Mato Grosso do Sul had an industrial GDP of R $19.1 billion in 2017, equivalent to 1.6% of the national industry. It employs 122,162 workers in the industry. The main industrial sectors are: Public Utility Industrial Services, such as Electricity and Water (23.2%), Construction (20.8%), Food (15.8%), Pulp and Paper (15.1%) and Petroleum Derivatives and Biofuels (12.5%). These 5 sectors concentrate 87.4% of the state's industry.[83]

Mato Grosso had an industrial GDP of R $17.0 billion in 2017, equivalent to 1.4% of the national industry. It employs 141,121 workers in the industry. The main industrial sectors are: Construction (32.0%), Food (27.9%), Industrial Services of Public Utility, such as Electricity and Water (18.6%), Beverages (4.5%) and Oil Products Oil and Biofuels (3.9%). These 5 sectors concentrate 86.9% of the state's industry.[84]

The Federal District had an industrial GDP of R $8.4 billion in 2017, equivalent to 0.7% of the national industry. It employs 82,163 workers in the industry. The main industrial sectors are: Construction (53.4%), Industrial Services of Public Utility, such as Electricity and Water (22.2%), Food (7.2%), Beverages (6.0%) and Non-minerals -metallics (3.0%). These 5 sectors concentrate 91.8% of the state's industry.[85]

In Northeast Region, Bahia has 4.4% of the national industrial GDP,[86] Pernambuco 2.7%,[87] Ceará 1.9%,[88] Maranhão 1.1%,[89] Rio Grande do Norte 0.9%,[90] Paraíba 0.7%,[91] Sergipe 0.6%,[92] Alagoas 0.5%[93] and Piauí 0.4%,[94] num overall total of approximately 13.2%.

In the Northern Region, Pará has 3.7% of the national industrial GDP,[95] Amazonas 2.2%,[96] Rondônia 0.7%,[97] Tocantins 0.4%,[98] Amapá 0.1%,[99] Acre 0.1%[100] and Roraima 0.1%,[101] in an overall total of approximately 7.3%.

Energy

The main characteristic of the Brazilian energy matrix is that it is much more renewable than that of the world. While in 2019 the world matrix was only 14% made up of renewable energy, Brazil's was at 45%. Petroleum and oil products made up 34.3% of the matrix; sugar cane derivatives, 18%; hydraulic energy, 12.4%; natural gas, 12.2%; firewood and charcoal, 8.8%; varied renewable energies, 7%; mineral coal, 5.3%; nuclear, 1.4%, and other non-renewable energies, 0.6%.[102]

In the electric energy matrix, the difference between Brazil and the world is even greater: while the world only had 25% of renewable electric energy in 2019, Brazil had 83%. The Brazilian electric matrix is composed of: hydraulic energy, 64.9%; biomass, 8.4%; wind energy, 8.6%; solar energy, 1%; natural gas, 9.3%; oil products, 2%; nuclear, 2.5%; coal and derivatives, 3.3%.[102]

In total electricity generation, in 2019 Brazil reached 170,000 megawatts of installed capacity, more than 75% from renewable sources (the majority, hydroelectric plants).[103][104] In 2019, Brazil had 217 hydroelectric plants in operation, with an installed capacity of 98,581 MW, 60.16% of the country's energy generation.[105] Brazil is one of the 5 largest hydroelectric energy producers in the world (2nd place in 2017).[106]

In 2013, the Southeast used about 50% of the load of the National Integrated System (SIN), being the main energy consuming region in the country. The region's installed electricity generation capacity totaled almost 42,500 MW, which represented about a third of Brazil's generation capacity. The hydroelectric generation represented 58% of the installed capacity in the region, with the remaining 42% basically corresponding to the thermoelectric generation. São Paulo accounted for 40% of this capacity; Minas Gerais by about 25%; Rio de Janeiro by 13.3%; and Espírito Santo for the rest. Among the renewable sources for thermoelectric generation, sugar cane biomass stands out, with more than 6,300 MW of capacity, distributed in more than 230 plants. Among the non-renewable sources, natural gas, with almost 6,300 MW, thermonuclear generation, with 2,000 MW, and oil products, with 1,100 MW.[107]

The South Region has the Itaipu Dam, which was the largest hydroelectric plant in the world for several years, until the inauguration of the Three Gorges Dam in China. The region is also the only one in the country that produces coal and oil shale.

Northern Brazil has large hydroelectric plants such as Belo Monte and Tucuruí, which produce much of the national energy.

Brazil's hydroelectric potential has not yet been fully explored, so the country still has the capacity to build several renewable energy plants in its territory.

In the Northeast region, the installation of wind farms is multiplying. In 2019, it was estimated that the country had an estimated wind power generation potential of around 522 GW (this, only onshore), enough energy to meet three times the country's current demand.[108][109] As of January 2022, according to ONS, total installed capacity of wind power was 21 GW, with average capacity factor of 58%.[110][111] While the world average wind production capacity factors is 24.7%, there are areas in Northern Brazil, specially in Bahia State, where some wind farms record with average capacity factors over 60%;[112] the average capacity factor in the Northeast Region is 45% in the coast and 49% in the interior.[113] In 2019, wind energy represented 9% of the energy generated in the country.[114] Brazil is one of the 10 largest wind energy producers in the world (8th place in 2019, with 2.4% of world production).[115][116]

Brazil also has 3 atomic plants. In Angra dos Reis, in the state of Rio de Janeiro, is the Central Nuclear Almirante Álvaro Alberto, a complex formed by the group of nuclear plants 'Angra 1' , 'Angra 2' and 'Angra 3' (under construction), owned by Eletronuclear, a subsidiary of Eletrobras. The complex produces three percent of the National Interconnected System electricity consumption. The total power of the plants is 2007 MW, of which 657 MW in Angra 1 and 1350 MW in Angra 2. Additionally, the Angra 3 nuclear plant, which will have a capacity of 1405 MW, is under construction.[117][118]

As of March 2022, according to ONS, total installed capacity of photovoltaic solar was 14 GW, with average capacity factor of 23%.[119] Some of the most irradiated Brazilian States are MG ("Minas Gerais"), BA ("Bahia") and GO (Goiás), which have indeed world irradiation level records.[120][121] In 2019, solar power represented 1.27% of the energy generated in the country.[114] In 2020, Brazil was the 14th country in the world in terms of installed solar power (7.8 GW).[122]

In 2020, Brazil was the 2nd largest country in the world in the production of energy through biomass (energy production from solid biofuels and renewable waste), with 15,2 GW installed.[123]

Cars

Brazilian automobile production began in 1957, with an initial production of 1,166 units in the first year. Most production is concentrated in the states of São Paulo, Minas Gerais and Paraná.

The automotive industry in Brazil boomed after ex-president Fernando Collor de Mello opened up the market in 1990, but high production costs, high taxes and technology deficits are barriers that Brazil is still struggling to defeat.

Brazil's automotive industry has been displaying impressive two-digit growth over the last years, totaling revenues over USD 100 billion by the end of 2010. These figures secured Brazil the fourth position amongst the largest car markets in the world (one position ahead of Germany). The industry generates 1.5 million jobs.

The perspective of a steady development of the industry is attracting billions in investments to the country. BMW announced in December 2011 plans to set up a plant in São Paulo, and by 2014 Chinese manufacturer JAC Motors was to officially start production on the assembly line being built in Bahia state.[124]

| Year | 1960 | 1970 | 1980 | 1990 | 2000 | 2004 | 2005 | 2007 | 2008 |

| Units (in millions) | 0.042 | 0.306 | 0.933 | 0.663 | 1.36 | 1.86 | 2.50 | 2.61 | 2.97 |

Petroleum

The northeast shore of the Bay of All Saints was home to Brazil's first active oil fields. The municipality of São Francisco do Conde at the north of the bay remains a port serving the refineries at Mataripe. The bay is dredged from the port to the Atlantic Ocean to remain open to shipping.[127]

| Year | 1960 | 1970 | 1980 | 1990 | 2000 | 2006 |

| Thousand barrels per day | 83 | 169 | 189 | 653 | 1,271 | 1,809 |

Statistics

Electricity:[129]

- production: 380 TWh (2004)

- consumption: 391 TWh (2004)

Electricity - production by source: (2004)[129]

- other sources: 9%

- hydroelectric: 83%

- conventional thermal: 4%

- nuclear: 4%

Oil:[130]

- production: 2.165 million barrel/day (2006)

- consumption: 2.216 million barrel/day (2006)

- imports: 0.051 million barrel/day (2006)

- proven reserves: 11.2 billion barrels (2006)

- refinery capacity: 1.908 million barrel/day (2006)

Natural gas:[130]

- production: 9.88 billion cubic kilometers (2006)

- consumption: 19.34 billion cubic kilometers (2006)

- imports: 9.45 billion cubic kilometers (2006)

- proven reserves: 326 billion cubic kilometers (2006)

See also

References

- ↑ Szmrecsány, p. 282

- ↑ Szmrecsány, p. 283

- ↑ Szmrecsány, p. 285-7

- ↑ "Archived copy" (PDF). Archived from the original (PDF) on 2 February 2019. Retrieved 26 June 2020.

{{cite web}}: CS1 maint: archived copy as title (link) - ↑ "Archived copy" (PDF). Archived from the original (PDF) on 24 August 2019. Retrieved 26 June 2020.

{{cite web}}: CS1 maint: archived copy as title (link) - ↑ "Embraer vê clientes mais dispostos à compra de aviões". 10 October 2010.

- ↑ Szmrecsány, p. 294

- ↑ Sodré, p.198-200

- ↑ Szmrecsány, p. 290

- ↑ Vainfas, p. 373

- ↑ Szmrecsány, p. 291

- 1 2 Vainfas, p. 374

- ↑ "A torre antiga e a nova torre" (PDF) (in Portuguese). HistóriaOral.org.br. Retrieved 28 March 2017.

- ↑ Szmrecsány, p. 318-9

- ↑ Szmrecsány, p. 308

- 1 2 Vainfas, p. 375

- ↑ Szmrecsány, p. 300

- 1 2 Vianna, p. 496

- ↑ Szmrecsány, p. 298

- ↑ Szmrecsány, p. 298-300

- ↑ Szmrecsány, p. 295–296

- ↑ Szmrecsány, p. 296

- 1 2 Sodré, p. 200

- ↑ Szmrecsány, p. 185

- ↑ Vainfas, p. 373, 375

- 1 2 Graça Filho, p. 80

- ↑ Graça Filho, p. 84

- ↑ Vainfas, p. 376

- ↑ Silva, p.61

- ↑ Silva, p. 60

- ↑ Mola de emprego e do PIB, indústria brasileira não reage e emperra avanço da economia

- ↑ Indústria perde 1,3 milhão de empregos em quatro anos

- ↑ Setor Automotivo

- ↑ O novo mapa das montadoras

- ↑ Indústria automobilística do Sul do Rio impulsiona superavit na economia

- ↑ Sem cortar direitos, Paraná se torna o segundo maior polo automotivo do Brasil

- ↑ Brasil supera Espanha e é o 8º maior produtor de veículos

- ↑ Produção de tratores no Brasil

- ↑ "Composição do PIB do estado do Rio de Janeiro". Archived from the original on 14 June 2020. Retrieved 20 July 2020.

- ↑ "Rio aumenta sua participação na produção nacional de petróleo e gás". Archived from the original on 27 October 2020. Retrieved 20 July 2020.

- ↑ Anuário Mineral Brasileiro 2017

- ↑ O peso da mineração na Região Sudeste

- ↑ Ibram: produção de minério em 2019 caiu, mas faturamento cresceu

- 1 2 3 4 5 Anuário Mineral Brasileiro 2018

- ↑ Brasil extrai cerca de 2 gramas de ouro por habitante em 5 anos

- ↑ Votorantim Metais adquire reservas de zinco da Masa

- ↑ Nióbio: G1 visita em MG complexo industrial do maior produtor do mundo

- ↑ Goiás lidera produção de níquel

- ↑ Minas Gerais produz 32,3% do aço nacional em 2019

- ↑ Produção nacional de celulose cai 6,6% em 2019, aponta Ibá

- ↑ Sabe qual é o estado brasileiro que mais produz Madeira? Não é São Paulo...

- 1 2 São Mateus é o 6º maior produtor de madeira em tora para papel e celulose no país, diz IBGE

- ↑ Made in Espírito Santo: celulose capixaba é usada em papel até do outro lado do mundo

- ↑ Volta do pré-sal impulsiona setor naval

- ↑ Em 2 anos, indústria naval perde quase metade do pessoal ocupado no Brasil

- ↑ Setor naval afunda

- ↑ Indústria Química no Brasil

- ↑ Estudo de 2018

- ↑ Produção nacional da indústria de químicos cai 5,7% em 2019, diz Abiquim

- ↑ A indústria de alimentos e bebidas na sociedade brasileira atual

- ↑ Faturamento da indústria de alimentos cresceu 6,7% em 2019

- ↑ "Indústria de alimentos e bebidas faturou R$ 699,9 bi em 2019". 18 February 2020.

- ↑ Roche investe R$ 300 milhões na fábrica do Rio de Janeiro

- ↑ "Saiba como está a competição no mercado farmacêutico brasileiro". Archived from the original on 22 October 2020. Retrieved 20 July 2020.

- ↑ Saiba quais são os principais polos calçadistas do Brasil

- ↑ Industrias calcadistas em Franca SP registram queda de 40% nas vagas de trabalho em 6 anos

- ↑ Produção de calçados deve crescer 3% em 2019

- ↑ Abicalçados apresenta Relatório Setorial 2019

- ↑ Exportação de Calçados: Saiba mais

- ↑ "Histórico da Vulcabrás". Archived from the original on 21 June 2020. Retrieved 20 July 2020.

- ↑ História da Alpargatas

- ↑ Página 17

- 1 2 A indústria eletroeletrônica do Brasil – Levantamento de dados

- ↑ Desempenho do Setor - DADOS ATUALIZADOS EM ABRIL DE 2020

- ↑ "Um setor em recuperação". Archived from the original on 25 September 2020. Retrieved 20 July 2020.

- ↑ Profile of the Industry of São Paulo

- 1 2 Minas Gerais Industry Profile

- ↑ Rio de Janeiro Industry Profile

- ↑ Paraná Industry Profile

- ↑ Rio Grande do Sul Industry Profile

- ↑ Santa Catarina Industry Profile

- ↑ Goiás Industry Profile

- ↑ Industry Profile of Mato Grosso do Sul

- ↑ Industry Profile of Mato Grosso

- ↑ Industry Profile of the Federal District

- ↑ Bahia Industry Profile

- ↑ Industry Profile of Pernambuco

- ↑ Industry Profile of Ceará

- ↑ Profile of Maranhão Industry

- ↑ Industry Profile of Rio Grande do Norte

- ↑ Paraíba Industry Profile

- ↑ Industry Profile of Sergipe

- ↑ state/al Industry Profile of Alagoas

- ↑ Industry Profile of Piauí

- ↑ Pará Industry Profile

- ↑ Industry Profile of Amazonas

- ↑ Rondônia Industry Profile

- ↑ Profile of Tocantins Industry

- ↑ Amapá Industry Profile

- ↑ Industry Profile of Acre

- ↑ Industry Profile of Roraima

- 1 2 Matriz Energética e Elétrica

- ↑ "Brasil alcança 170 mil megawatts de capacidade instalada em 2019". Archived from the original on 13 April 2021. Retrieved 20 July 2020.

- ↑ "IEMA (Instituto de Energia e Meio Ambiente),2016.Série TERMOELETRICIDADE EM FOCO: Uso de água em termoelétricas" (PDF). Archived from the original (PDF) on 1 April 2018.

- ↑ "How many power generating plants do we have in Brazil?". 5 April 2019.

- ↑ "Brasil desponta como terceiro maior produtor de eletricidade das Américas • Abrapch". 24 March 2017.

- ↑ O BNDES e a questão energética e logística da Região Sudeste

- ↑ Ventos promissores a caminho

- ↑ Brazilian onshore wind potential could be 880 GW, study indicates

- ↑ "Boletim Mensal de Geração Eólica Agosto/2021" (PDF) (in Portuguese). Operador Nacional do Sistema Elétrico – ONS. 1 August 2021. pp. 6, 14. Retrieved 18 December 2021.

- ↑ "Brasil atinge 21 GW de capacidade instalada de energia eólica" (in Brazilian Portuguese). Valor. 21 January 2022. Retrieved 5 March 2022.

- ↑ "Brasil é o país com melhor fator de aproveitamento da energia eólica". Governo do Brasil (in Brazilian Portuguese). Archived from the original on 7 October 2018. Retrieved 7 October 2018.

- ↑ "Boletim Trimestral de Energia Eólica – Junho de 2020" (PDF) (in Brazilian Portuguese). Empresa de Pesquisa Energética. 23 June 2020. p. 4. Retrieved 24 October 2020.

- 1 2 Quantas usinas geradoras de energia temos no Brasil?

- ↑ "GWEC Global Wind Report 2019". Global Wind Energy Council. 25 March 2020. pp. 25, 28. Retrieved 23 October 2020.

- ↑ "Global Wind Report 2019". Global Wind Energy Council. 25 March 2020. p. 10. Retrieved 23 October 2020.

- ↑ Operador Nacional do Sistema Elétrico - ONS. Histórico da Operação Archived 7 August 2012 at the Wayback Machine

- ↑ Site da Eletronuclear

- ↑ "Geração solar no Brasil atinge 14 GW, potência equivalente à usina de Itaipu" (in Brazilian Portuguese). Terra. 2 March 2022. Retrieved 5 March 2022.

- ↑ "Quais as melhores regiões do Brasil para geração de energia fotovoltaica? – Sharenergy". Sharenergy (in Brazilian Portuguese). 3 February 2017. Retrieved 7 October 2018.

- ↑ "Boletim Mensal de Geração Solar Fotovoltaica Agosto/2021" (PDF) (in Portuguese). Operador Nacional do Sistema Elétrico – ONS. 1 August 2021. pp. 6, 13. Retrieved 18 December 2021.

- ↑ RENEWABLE CAPACITY STATISTICS 2021

- ↑ "RENEWABLE CAPACITY STATISTICS 2021 page 41" (PDF). Retrieved 24 May 2021.

- ↑ "Business in Brazil". All you need to know about Immigration and Relocation to Brazil. Retrieved 25 October 2015.

- ↑ Ipeadata

- ↑ Produção de veículos bate recorde em 2007; 86% dos carros vendidos já são flex - O Globo Online

- ↑ "Todos os Santos Bay". Encyclopædia Britannica. Encyclopædia Britannica. 2014. Retrieved 15 December 2014.

- ↑ "Redir timeout". Archived from the original on 20 October 2007. Retrieved 2 September 2007.

- 1 2 Brazil Energy Data, Statistics and Analysis - Oil, gas, electricity, coal

- 1 2 "EIA - International Energy Data and Analysis for Brazil". Archived from the original on 18 November 2010. Retrieved 6 May 2008.

Bibliography

- Furtado, Celso. Formação econômica do Brasil. (http://www.afoiceeomartelo.com.br/posfsa/Autores/Furtado,%20Celso/Celso%20Furtado%20-%20Forma%C3%A7%C3%A3o%20Econ%C3%B4mica%20do%20Brasil.pdf)

- Prado Junior, Caio. História econômica do Brasil. (http://www.afoiceeomartelo.com.br/posfsa/Autores/Prado%20Jr,%20Caio/Historia%20Economica%20do%20Brasil.pdf)

- Graça Filho, Afonso de Alencastro. A economia do Império brasileiro. São Paulo: Atual, 2004. (in Portuguese)

- Scantimburgo, João de. O Poder Moderador. São Paulo: Secretaria de Estado da Cultura, 1980. (in Portuguese)

- Silva, Hélio. 1889 - A república não esperou o amanhecer. Porto Alegre: L&PM, 2005. (in Portuguese)

- Sodré, Nelson Werneck. Panorama do Segundo Império, 2. ed. Rio de Janeiro: GRAPHIA, 2004. (in Portuguese)

- Szmrecsány, Tamás and Lapa, José Roberto do Amaral. História Econômica da Independência e do Império, 2. ed. São Paulo: USP, 2002. (in Portuguese)

- Vainfas, Ronaldo. Dicionário do Brasil Imperial. Rio de Janeiro: Objetiva, 2002. (in Portuguese)

- 15. ed. São Paulo: Melhoramentos, 1994. (in Portuguese)

.jpg.webp)