| Corporate income tax rate | 9% | ||

| Branch tax rate | 9% | ||

| Minimum tax | Applied to 2% of adjusted gross profit | ||

| Capital gains tax rate | 9% | ||

| Tax basis | Worldwide income | ||

| Participation exemption | Yes | ||

| Loss relief | Carryforward: Indefinite, but limitations apply Carryback: Generally not available | ||

| Double taxation relief | Yes | ||

| Tax consolidation | For VAT purposes | ||

| Transfer pricing rules | Yes | ||

| Thin capitalization rules | Yes (ratio 3:1) | ||

| Controlled foreign corp. rules | Yes | ||

| Tax year | Calendar year, but different fiscal year may be elected | ||

| Advance payment of tax | Monthly/quarterly | ||

| Return due date | Last day of the fifth month following of the end of the fiscal year | ||

| Withholding tax | Dividends: 0% Interest: 0% Royalties: 0% Branch remittance tax: 0% | ||

| Social security contributions | 13% of gross wages for the employer (from 2022) | ||

| Capital tax | No | ||

| Building tax/land tax | May apply at municipal level | ||

| Real estate transfer tax | 4% up to a value of HUF 1bn (€3.3 million) and 2% on the excess, capped at HUF 200 million (€0.65 million) | ||

| Local business tax | maximum 2% of net sales revenue | ||

| Innovation contribution | 0.3% | ||

| Financial transaction tax | 0.3% of transferred amount maximum HUF 6000 (€20) | ||

| VAT | 27% (standard), 18%, 5% | ||

| Hungary quick tax facts for Individuals (2017), Source: Deloitte.[1] | |||

| Income tax rate | 15% | ||

| Capital gains tax rate | 15% | ||

| Tax basis | Worldwide income | ||

| Double taxation relief | Yes | ||

| Tax year | Calendar year | ||

| Return due date | 20 May (Tax authority prepares it electronically to everyone automatically) | ||

| Withholding tax | Dividends: 15% Interest: 15% Royalties: 15% | ||

| Healthcare contribution | 14% or 22% on some income maximum annual HUF 450 000 (€1460) | ||

| Social security contributions | 18.5% of gross wages for the employee | ||

| Net wealth tax | No | ||

| Inheritance and gift tax | 9% or 18% | ||

| Real estate tax | May apply at municipal level | ||

| VAT | 27% (standard), 18%, 5% | ||

| Part of a series on |

| Taxation |

|---|

|

| An aspect of fiscal policy |

Taxation in Hungary is levied by both national and local governments. Tax revenue in Hungary stood at 38.4% of GDP in 2017.[2] The most important revenue sources include the income tax, Social security, corporate tax and the value added tax, which are all applied at the national level. Among the total tax income the ratio of local taxes is solely 5% while the EU average is 30%.[3]

Income tax in Hungary is levied at a flat rate of 15%.[4] A tax allowance is given through a family allowance (Hungarian: családi adókedvezmény), which is equal to the allowance multiplied by the number of "beneficiary dependent children". For one or two children the allowance is HUF 62,500 per child, for three or more HUF 206,250 per child.[5] The allowance can be split between spouses or life partners.

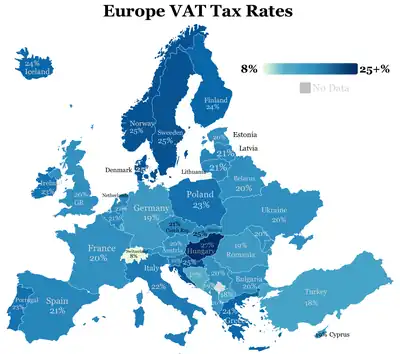

The standard rate of value added tax is 27% as of January 2012 — the highest in the European Union.[6] There is a reduced rate of 5% for most medicines and some food products, and a reduced rate of 18% for internet connections, restaurants and catering, dairy and bakery products, hotel services and admission to short-term open-air events.[7]

In January 2017, corporate tax was unified at a rate of 9% — the lowest in the European Union.[8] Dividends received are not subject to taxation, provided that are not received from a Controlled Foreign Company (CFC). Capital gains are included in corporate tax, with certain exemptions.[9]

Employment income is subject to social security contributions for the employer at a flat rate of 17,5%.[10] Capital gains are taxed at a flat rate of 15%.[11]

History

After the Ottoman conquest of central parts of Hungary, the most common tax was the Ottoman administration's levy on Christians the dhimmi. Under Austro-Hungarian rule, taxes were mostly levied by Austria, but Hungary was later given more financial autonomy in the Austro-Hungarian Compromise of 1867.[12] In 1988, liberalization of the Soviet-influenced Kádár government introduced tax reform, establishing a comprehensive tax system of central and local taxes, consisting mainly of a personal income tax, a corporate income tax and a value added tax.[13]

References

- 1 2 "Taxation and Investment in Hungary (rates are updated to 2017)" (PDF). Retrieved 29 May 2017.

- ↑ "Tax to GDP". 2018-12-03.

- ↑ "Adózás (Taxation)" (in Hungarian). Retrieved 18 January 2010.

- ↑ "TMF Group Income tax Hungary".

- ↑ "Family Allowance 2014". angloinfo.com. Retrieved 14 January 2018.

- ↑ "Deloitte Tax News » Hungary: Corporate Income Tax and VAT changes 2012". Deloittetax.at. 1 January 2012. Retrieved 2 April 2012.

- ↑ "VAT 2014 KPMG". KPMG. 2019-08-07.

- ↑ "Hungary to offer EU's lowest corporate tax rate". Financial Times. 17 November 2016.

- ↑ "Residency and Incorporation in Hungary". flagtheory.com. 2017-01-30. Retrieved 2017-04-20.

- ↑ "KPMG – taxes H2 2019". 16 November 2021.

- ↑ "Capital gains tax". clearstream.com.

- ↑ Sowards, Stephen W. (11 June 2009). "Nationalism in Hungary, 1848-1867". Michigan State University. Retrieved 14 January 2018.

- ↑ Hőgye, Mihály. "Reflection on the Hungarian Tax System and Reform Steps" (PDF). Petru Maior University of Târgu Mureș. Archived from the original (PDF) on 5 October 2011. Retrieved 18 January 2010.